What’s new

Administrative topics and an introduction

Well folks, a new administration has taken office and markets have continued to rally. Maybe it really is 1999 all over again, but this time we have a better ending? Only time will tell. In the meantime, try your best not to rock the boat too much.

P.S. check out the updated Behind the Madness via the button below! It is BEEFY, now with links to free video courses, institutional research sources, and learning/training resources as well as a discount code on paid courses from CFI if you’re looking to expand your knowledge.

Let’s get into some stories.

Did you miss the last edition? No worries! Get it right here and catch up on the madness.

Fundamentals

Where did the markets end last week?

U.S. Indices 5 Day Performance

Dow Jones: +0.63%

S&P 500: +1.96%

NASDAQ: +4.19%

Asia and Europe 5 Day Performance

Nikkei 225: +0.39%

Hang Seng: +3.06%

FTSE 100: -0.60%

DAX: -0.63%

Rates, Spot Prices, and ‘Good to Knows’

Market Madness Portfolio: +1.10% (5-day performance)

US 10 YR: 1.086%

Crude OIL: $51.98

Spot Gold: $1,854.80

TEDRATE: 0.13

LIBOR (3 month): 0.21775%

U.S. Dollar Index: 90.238

EUR/USD: $1.217

Pound/USD: $1.368

USD/JPY: 103.761 JPY

USD/CNY: 6.481 CNY

Weekly update

An article by Christopher

Financial markets

As mentioned earlier, the equity rally continues, despite a couple of down days this week. The supposed “mega crash” following the inauguration of Joey B. was nowhere to be seen and the proposed “reflation trade” continues marching onward. A few hurdles appear to be nothing to the full-on flying brick house that is U.S. equities (particularly if you’re the NASDAQ - purple line below).

This past week was the start of the earnings calls for Q4 2020, starting with a lot of the big banks on the Street. Goldman and JPMorgan announced stellar Q4 performance and the majority of firms that reported last week reporting earnings per share (EPS) above the Street’s expectations. Next week, we continue with many more earnings calls, and the Street is expecting more of what we’ve been seeing already.

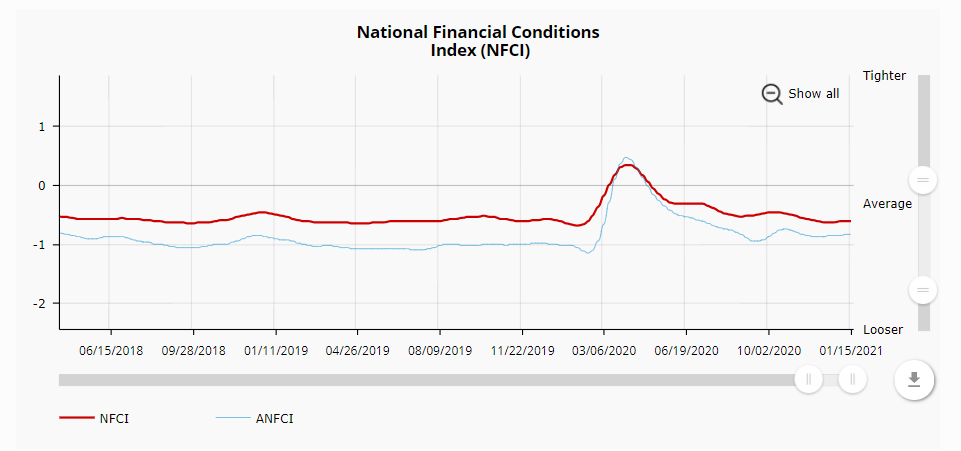

According to the National Financial Conditions Index (NFCI) from the Chicago Fed, markets remain loose and liquid, with declining (but still above average) levels of leverage (as measured by an NFCI subindex, not displayed).

Despite a great deal of record performance by firms in H2 2020, investors are never satisfied; they always want more.

“Corporate executives face rising investor expectations going into the fourth-quarter earnings season that the economic outlook would soon brighten despite an accelerating toll from the coronavirus.” (excerpted from WSJ article)

This is a topic we will look at more deeply in the following article of this edition, but this is likely to be a pressing issue for investors as we move further into 2021. We won’t see much of the further celebration or misery of missed expectations until we get Q1 2021 earnings reports, which are still a long way off.

Investors have grown to become single object-oriented beings: stocks must go up, instead of seeing and adjusting to risk-on, risk-off periods. Where we start to run into trouble is if (more so when) stocks start coming back down to Earth.

Bonus: “When Bond Prices Are a Matter of Opinion.” (via Morningstar)

Economic data and stimulus

There were a few highlights in the economic world this past week. One, as you could probably guess, was the high level of new and continuing jobless claims, and the other was the confirmation hearing of Janet Yellen for Treasury Secretary.

Jobless claims continue to be an economic doozy for the United States. New claims came in above expectations at around 900K (versus expected 888K) while continuing claims came in under expectations at 5,054K (versus expected 5,390K). Nevertheless, new claims hovering just under one million for two weeks now is cause for concern among economists.

Given the transition of power this week, stimulus talks remain just talk. But with a Dem sweep on the Hill, it is likely that both floors will be taking up an enhanced package in the coming weeks. The senate is still working to push across new nominations, namely the new Treasury Secretary Janet Yellen. Yellen formerly served as the chairwoman of the Federal Reserve here in the U.S. from 2014 - 2018.

There are some general “concerns” (although concerns is not necessarily the right word here) regarding some of the ideas and intentions Yellen brings to the table, namely a higher corporate tax rate and what she will do to reign in the Fed balance sheet that is off up at the moon currently.

Understandably, all of her plans take the backseat to managing the pandemic, which has led her to advocate for additional stimulus from the folks on the Hill. A stronger coordination between Yellen and Powell might yield a new dynamic duo since they both think in similar fashion given their overlapping work history.

What goes up…

An article by Christopher

As touched on earlier, the superb market performance continues to put pressure on corporates to continue the gains from 2020 into 2021.

“Companies reporting results in coming weeks are under heightened pressure to spell out how their performance in 2021 is likely to justify share-price gains notched during an epic stock-market rally.” (excerpted from WSJ article)

Sir Isaac Newton must have been a finance guy on the side because investment vehicles (at least on a shorter time horizon than infinity) do in fact fall after going up.

Now, if you zoom out far enough on a time horizon, stocks always go up. But thinking this way on a shorter, trade-oriented approach is just nonsense (especially when your trade hold is 30-60 days). At least this is true when fundamentals hold bearing, which they currently do not.

“Sometimes it’s hard to argue that market capitalism has any chance of correctly allocating money to the companies that can use it best. Case in point: Stock-market performance this year has been driven by the raw share price, with lower-priced stocks doing better and higher-priced worse.

Forget a careful evaluation of future cash flow, valuation, brand power, management skill or even political sensitivity. I repeat: The best explanation for how stocks have moved so far this year is the price of the stock, an almost meaningless number.” (excerpted from WSJ article)

The cynics among us will jump up and down, exclaiming “we’ve lost all hope for market efficiency!!!” In some respects, they’re not wrong. The markets have performed generally well, taking even the laggards of the pack up with the tide. However, this will not and cannot be sustained forever.

COVID 19 and all its might shocked the financial world in a unique and (roll your eyes for this adjective) unprecedented way. And, as a result, instead of an impending doomsday sell-off, we’re discussing profit-taking and all-time highs in the markets. This DOES NOT happen in a normal financial catastrophe. If you don’t believe me, take a look at the past two financial disasters: 2008 (GFC) and 2001 (dot com). There are some winners, of course, but the majority of the world loses in those situations. Instead, what we’re seeing is that even the most novice investor with a couple grand and an internet connection are acting like the next Buffett.

Now I am still bullish on equities, at least in the rolling 30 day time horizon, don’t get me wrong. However, at the end of the day, fundamentals determine how effectively the company is operating and being run by the management, not the stock chart.

Stay sharp out there, and when the tide eventually goes out on equities, don’t get carried off with it.

The flaming marshmallow

An article by Christopher

This past week, Walt at The Heisenberg Report went off on some philosophical prose about financial bubbles. For those subscribed, or still have some free reads available for this month, I highly suggest visiting the “read more” links. For the rest, I will summarize and comment on them right here.

Let’s start with some of Walt’s own words:

“Valuations are extreme, although, as documented extensively in this instant classic, it’s difficult to say whether a given asset class is or isn’t a “bubble.”

In fact — and I think this is important — making such pronouncements is impossible.

Market participants, and especially veterans and those who’ve been lucky enough to have called tops previously, have a tendency to pass off subjective judgments as objective facts. Financial journalists do the same thing. Habitually.

Let me just put this as plainly as possible: The only way a reference to “bubbles” can be anything other than a subjective judgement is if the reference is to thin spheres of liquid enclosing air (or another gas). Those are bubbles. In a noun sense. There’s also a verb sense which also refers to an objective reality. You can boil something until it “bubbles,” for example.

Outside of those two instances, “bubble” is wholly subjective. So, when you look at the following simple chart, just know that describing it as a “bubble” is not only subjective, it’s meaningless. “Bubble” doesn’t mean “paying 30X for a dollar of earnings.” Again, “bubble,” as a noun, is a thin sphere of liquid enclosing air (or another gas). Period.”

The main point here is that these financial anomalies happen due to a wide variety of different conditions, not just for the same cookie cutter reason. Because of this, one cannot easily spot a supposed “bubble” and call it a “bubble.” Instead, “bubble” has been used so much to describe so many things in finance now that is virtually has no meaning. Instead of “bubble,” Walt has decided on “flaming marshmallow” and I think it quite well fits. Something can be a flaming marshmallow if it demonstrates a characteristic that is out of the normal but does not lead to the inclination that it is the beginning of or is a full-fledged “bubble.”

The whole commentary does raise interesting thoughts about how we consider financial market anomalies and how we address investor awareness of not getting washed out the tide so to speak when these “bubbles” pop or the flaming marshmallow completely burns to a crisp. Either way, the financial lingo always finds some way to make me laugh.

Read more here, here, here, and here.

Quick Takes

To fill in the gaps

COVID 19 deaths in the U.S. surpassed 400K this week, just 5 weeks after topping 300K. 500K expected in February.

Pre-Inauguration lockdown in D.C. (via WSJ)

Office supplies were never more interesting than they are now. (via WSJ)

China was the only major economy to report economic growth in 2020. (via WSJ)

U.S. hedge fund Elliott Management pulls plug on Hong Kong office. (via FT)

VW’s plan to beat Tesla gets foiled. (via WSJ)

Big banks pull big profits in Q4 2020. (via WSJ (1), WSJ (2))

Netflix does not need external financing anymore. (via CNBC)

Crypto market cap drops $100 billion over two-day sell-off. (via CNBC)

“Baupost’s Seth Klarman compares investors to ‘frogs in boiling water.’” (via FT)

China’s economy marches ahead, leaving consumers behind. (via WSJ)

London Metal Exchange proposes closing trading ring after 144 years. (via WSJ)

So, when are the folks over on WSB going to get hit with market manipulation? (via CNBC)

General Banter

What’s on the minds of our editors and writers

On a more personal note, I am incredibly humbled and honored by this past week. I’ve been taking some of the advice we’ve heard from Aman on here and from his own LinkedIn posts and I went on a small roadshow for Market Madness. I am proud to say that I’ve gotten MM submitted onto InboxReads and soon to be on LearnStash!

I’ve also become connected with some really great folks including Michael Walsh, David Belle of Macrodesiac, Michael Goodwell, Andrew, Mike and Justin at Bookshlf, and some other great finance writers on Substack: Wolf of Harcourt Street, An Allegory of Finance, and The Generalist.

Collectively, this little community has shared many insights and support related to MM and I want to thank each and every one of them! If you get connected with any of these folks, let them know you came from Market Madness!

Reader’s Corner

A place for suggestions for readers like you

The reader might enjoy this video from my good friend Afzal Hussein on some tips and tricks to make your first year on the job standout! How to Stand Out as a New Graduate in Banking or Consulting (THE GOOD GRAD - Episode #1)

This weekend, I picked up Josh Newman’s Project Management Core Concepts for Business Success report and it is 🔥🔥🔥! If you’re interested, reach out to him on Twitter and see his pinned tweet!

Also, enjoy this quality twitter thread I came across this week:

Well done. You’ve made it through the madness. I’ve worked hard to ensure that you leave this page having learned something, and I hope that it benefits you in your daily adventure. Thank you again for checking in.

Do you like what you have read? If you know of anyone missing Market Madness, save them the trouble, and share it with them!

Check out Behind the Madness for all the cool links and sign ups I used to have at the bottom of the weekly edition.