What’s new

Administrative topics and an introduction

Well folks, it was another wild week in 2021.

Nothing new administratively between last week and this week, but I will leave the below note for a few weeks to let folks catch up!

P.S. check out the updated Behind the Madness via the button below! It is BEEFY, now with links to free video courses, institutional research sources, and learning/training resources as well as a discount code on paid courses from CFI if you’re looking to expand your knowledge.

I also created a Discord server for the community to collect and chat about markets, economics, and anything else. Follow this link to join.

Let’s get into some stories.

Did you miss the last edition? No worries! Get it right here and catch up on the madness.

Fundamentals

Where did the markets end last week?

U.S. Indices 5 Day Performance

Dow Jones: -0.91%

S&P 500: -1.46%

NASDAQ: -1.54%

Asia and Europe 5 Day Performance

Nikkei 225: +1.35%

Hang Seng: +2.50%

FTSE 100: -1.98%

DAX: -1.86%

Rates, Spot Prices, and ‘Good to Knows’

Market Madness Portfolio: -0.22% (5-day performance)

US 10 YR: 1.09%

Crude OIL: $52.11

Spot Gold: $1,827.64

TEDRATE: 0.14

LIBOR (3 month): 0.22563%

U.S. Dollar Index: 90.772

EUR/USD: $1.207

Pound/USD: $1.358

USD/JPY: 103.871 JPY

USD/CNY: 6.480 CNY

Weekly update

An article by Christopher

Financial markets

Investors in the U.S. took profits from the markets this week, and with added stress from COVID 19 and the looming political discourse, U.S. markets ended up selling off this week.

What is not included above is the Russell 2000, the main index tracking small caps. Small caps crushed it this week, up about 1.50%. Many investors have piled into small caps, seeing them as an underappreciated sector of the market as most mainline investors and news commentary surrounds the major tech giants (FAT-G-MAN = Facebook, Apple, Tesla, Google, Microsoft, Amazon, Netflix — this is what used to be FAANG… I personally think FAT G MAN is a lot funnier and easier to remember).

The same concerns remain at the forefront of investor’s minds, albeit sporadically. Some days are days devoted to worrying about COVID 19, especially as new strains are being discovered and spreading across the globe quickly. Other days, market participants and experts are throwing their two cents in the ring, arguing that the all-time high valuations we’re seeing might just actually be too good to be true.

Something hanging over the financial world since the beginning of the pandemic are the massive reserves banks set aside for potential loan losses. At least the banks were prepared this time. Now, it appears to be a waiting game to see if these loan losses actually ever materialize. This past week, we saw JP Morgan release some of the reserve funds they had set aside, which helped boost their Q4 performance.

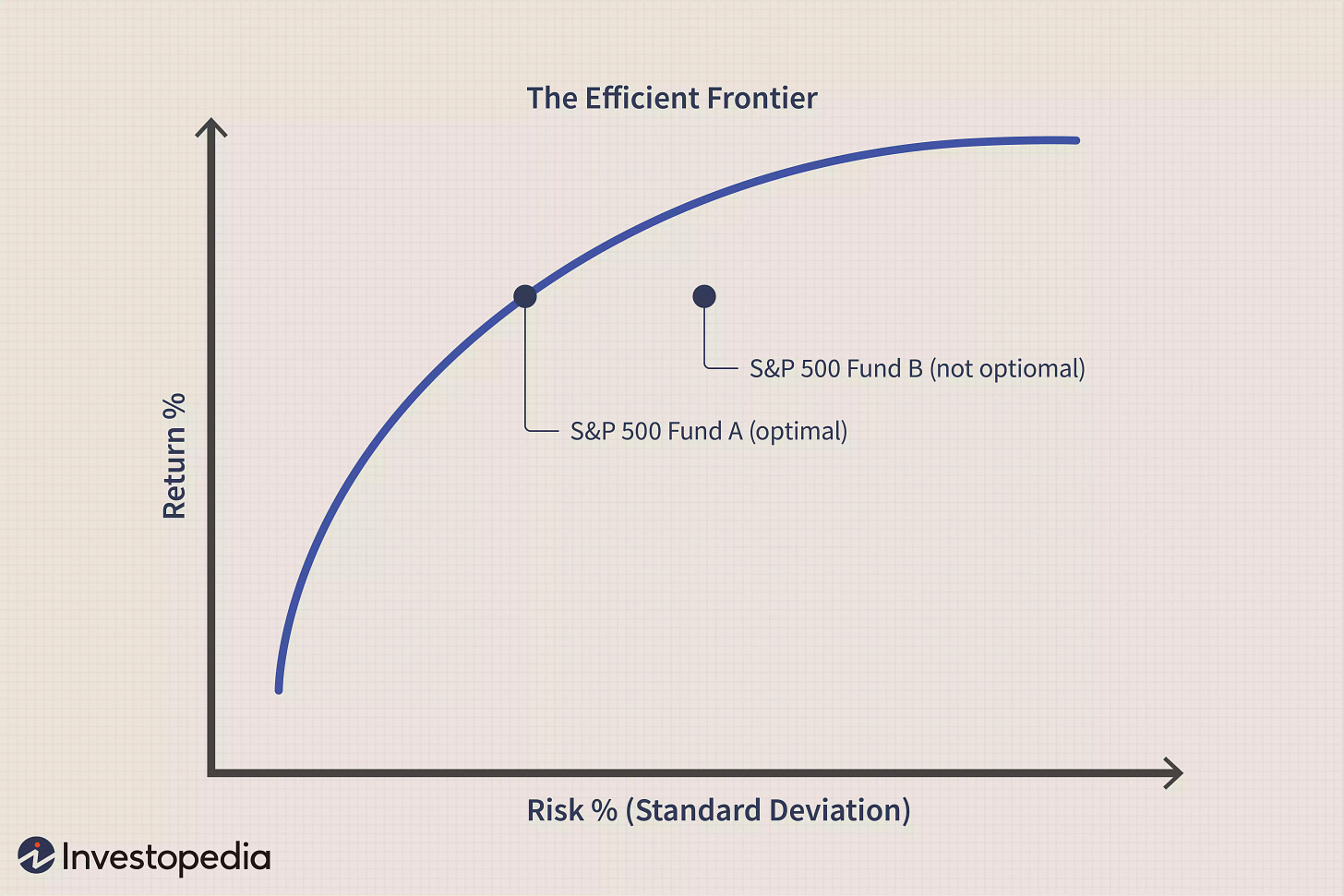

Finally, another trend that the market is noticing is the hunger for yield by investors. Treasuries have become much less desirable considering the indefinite low interest rate view set out by Jerome Powell and the Fed. As a result, investors have been piling into stocks, but also seeking riskier assets to provide them with their higher desired return. This risk seeking behavior is pushing investors further out the risk curve.

For the above diagram, we’re discussing moving further to the right along the blue curve, as investors are trying to identify investments that can generate higher return (but these also come with a considerably higher level of risk, as measured by standard deviation). Within this higher risk appetite environment, once neglected assets such as leveraged-loan funds are getting attention as well as other lower status instruments with potential for higher return, such as high-yield debt, or “junk bonds.”

After a while, the party is going to end, intelligent investors will take the majority of their profits (seeing the risk of the market become too much to be sustainable) and then the proverbial you know what hits the fan for everyone else, the so called “bag holders.”

Other general ideas for readers to keep in mind is the price action we’re seeing in crude oil as the Saudis are committing to more supply cuts to mechanically raise the price in the spot market as well as the ongoing commentary about firm valuations and how high is too high relative to their actual operational performance.

Read more here, here, here, here, here, and here.

Economic data and stimulus

As far as economics go, the picture sways between optimistic and gloomy very often. A nice summation of the picture as a whole would be: “uneven.”

Retail sales fell 0.7% in December, solidifying the fears over a weaker than normal holiday spending/shopping season. Zooming out, this has become a trend over the three previous months, signaling that consumers have moved away from spending in favor for saving. Some of this ongoing decline has been attributed to government gridlock over releasing new stimulus, and the fact that when they did, the direct checks were much lower than where the debates started. The more the ‘paycheck’ for the average American is stretched, the less willing they will become to spend more on non-essentials.

Speaking more directly to the “uneven” nature of the current economic picture in the U.S. is the unemployment reporting. For the lowest income bracket of paid workers in the U.S., the unemployment rate is above 20%. On top of that, we saw one of the worst weeks of new unemployment claims jumped to its biggest single week number since March when the pandemic was first settling in (965K versus 812K consensus for new claims and 5,271K versus 5,185K consensus for continuing claims). To make matters even worse, new job postings ended 2020 well below pre-pandemic levels as well.

All these data is to say that the concerns over a cooling labor market should be taken to heart and will likely become a longer, more attention-drawing concern in the weeks and months to come.

From the Fed’s point of view, a lot of the same has been reinforced. This week, Jerome Powell (from a very stylish kitchen) held a zoom press conference holding steady on no interest rate hikes so long as inflation stays as low as it is. With respect to their dual mandate, inflation has taken front and center attention, as employment takes the sideline, although inflation expectations, (according to Powell) will direct and dictate actions taken with respect to the ongoing employment situation.

Surrounding all of this, major players in the finance world are calling out central banks for exacerbating and facilitating economic inequality among other charges. I recommend reading the linked Axios piece on this topic to generate your own opinion on the matter, but I found this quote to be interesting:

Former FDIC chairwoman Sheila Bair was similarly unkind in her assessment of the Fed's actions in a Wall Street Journal editorial last week.

"Capitalism doesn’t work unless capital costs something and markets don’t work unless they’re allowed to rise and fall. The corporate facilities may have originally been justified as extraordinary one-off interventions to help companies maintain operations, but they morphed far beyond this purpose, and distorted capital allocation." (excerpted from Axios article)

Of course, as bitcoin bulls continue to protest centralized monetary and banking systems, the conversation around central bank influence and effectiveness is likely to remain at odds.

Just remember this quote from the Heisenberg Report:

“…it’s about the notion that Bitcoin, a thing which doesn’t exist in any real sense, has no internal rate of return, and no logical connection to any economic cycle, can be “fundamentally” valued…

I shouldn’t have to say this, but I do: “Stores of value” (and some, if not all, of Bitcoin’s proponents have described it as such), don’t generally suffer two-day declines of 20% or more. If they did, the world would be better off on a barter system.” (excerpted from The Heisenberg Report)

In just 24 hours, $150 billion in “value” was wiped away from Bitcoin and other coins, posed as “currency.” I’ll defer to the “house view” for any more Bitcoin related banter. Nevertheless, the conversation around centralized, regulated banking systems is likely to continue for some time.

Read more here, here, here, here, here, here, here, here, here, and here.

Quick Takes

To fill in the gaps

Exxon attracts SEC probe related to asset valuation. (via WSJ)

GM dabbles with flying cars, shares soar. (via CNBC)

Affirm IPO major success. (via WSJ)

Intel ousts CEO. (via WSJ)

Lost Bitcoin passwords caused loss in coin equal to $140 billion. (via NY Times)

BlackRock’s Barbara Novick set to retire. (via WSJ)

Petco returns to public market with a star-studded IPO, long term questions remain. (via CNBC)

Iran appears to be generating gear to assemble nuclear weapons material. (via WSJ)

JPMorgan’s homerun Q4 comes in wake of bad loan reserves that weren’t needed. (via WSJ)

Payment processor, Stripe, bans Donnie. (via WSJ)

Donnie’s second impeachment news. (via WSJ (1), WSJ (2), and CNBC)

General Banter

What’s on the minds of our editors and writers

I’ve shouted them out on the Behind the Madness page, but part two of Multiple Expansions’ Standalone Model tutorial just dropped. These two pieces are some of the most in-depth tutorials for model building that I’ve seen.

Part 3 is coming soon!

Reader’s Corner

A place for suggestions for readers like you

The reader might enjoy this analysis of Internet 3.0 from Stratechery.

Well done. You’ve made it through the madness. I’ve worked hard to ensure that you leave this page having learned something, and I hope that it benefits you in your daily adventure. Thank you again for checking in.

Do you like what you have read? Consider subscribing so that Market Madness is hand-delivered to your inbox each day! If you know of anyone missing Market Madness, save them the trouble, and share it with them!

Check out Behind the Madness for all the cool links and sign ups I used to have at the bottom of the weekly edition. To bring the best content each week, I dedicated a new page to them that will be continuously updated so I am not taking up space here each week.