What’s new

Administrative topics and an introduction

Well folks, only a few more weeks left in 2020 (thank goodness). It cannot get much worse, right? As long as “the monolith” (that big steel pillar from Utah) does not return in some other random, secluded place, we should experience smooth sailing into 2021. COVID 19 is still posing a formidable foe, with new cases and new deaths topping previous highs this past week. The major pharma players have submitted their pleas for emergency approval to the FDA and now we patiently wait for the approval, and distribution of the vaccine. What comes next, however, is likely going to be another difficult challenge that may have been overlooked: convincing the world en-mass to get the vaccine.

You might be thinking, “Wow, Christopher, you never stop talking about COVID on this financial journal…” and you’d be right. And there are plenty of happenings going on in the world each day within the realm of finance. But COVID 19 has me hooked. I am fascinated with the interplay between stimulus, federal reserve assistance, investor sentiment, and the economy as it pertains to COVID 19. It is something that no one has ever seen before and is to revolutionize how we learn about economics and finance.

My former professor (shoutout Professor Snyder) has already told me that he has to rework his entire Urban and Regional Economics class because the expectation is that centripetal forces drawing people closer to cities is going to be dominated by centrifugal forces pushing people into more ruralized settings. For years, even the last two decades or so, there has been a driving force that pushed people toward cities, both for work and for living, simply because that was where the opportunities are. As remote work becomes the dominant work environment and will likely be this way for the long-term future, there is no reason for people to crowd into a city (especially when viruses spread quickly in densely populated areas). When the world cools down from COVID 19 and the dust settles, we can talk at length about this in future issues!

One last administrative topic before the main event. I saved the best news for last; Aman is back in this edition! This week, he shares with us the importance of personal branding and some of the secret sauce that makes him successful in his personal branding efforts.

Did you miss the last edition? No worries! Get it right here and catch up on the madness. Consider subscribing down at the bottom of this newsletter so you never miss another edition and read from the comfort of your inbox.

Fundamentals

Where did the markets end last week?

U.S. Indices 5 Day Performance

Dow Jones: +1.16%

S&P 500: +1.72%

NASDAQ: +2.14%

Asia and Europe 5 Day Performance

Nikkei 225: +0.40%

Hang Seng: -0.18%

FTSE 100: +2.89%

DAX: -0.28%

Rates, Spot Prices, and ‘Good to Knows’

U.S. Dollar Index: 90.70

US 10 YR: 0.970%

Crude OIL: $46.11

Spot Gold: $1,838.50

Market Madness Portfolio: +18.83% YTD

TEDRATE: 0.14

LIBOR (3 month): 0.225%

Weekly update

An article by Christopher

Financial markets

Generally speaking, the financial markets in the U.S. performed well this past week. The switch shifted back to “risk on” behavior with investors ditching treasuries (indicated by higher yields we saw this week) and seeking stocks. Optimism continues to fill the air with the push for a vaccine and additional stimulus (we’ll talk about this in a bit).

It appears the market rally is widening across different sectors. An issue that we were noticing in the initial stock market rally was the missing breadth of the recovery. Tech stocks were booming and that was about it. Now, it appears that big tech is sharing the limelight with other sectors, allowing for a more robust breadth to the market recovery moving forward.

“Since Halloween it’s been a different story,” said Mariann Montagne, portfolio manager at Gradient Investments, noting the small-cap gauge’s recent outperformance of big tech stocks. “I believe that’s because we’re looking at a recovery in the market and in the economy, and small-caps tend to lead in recoveries.” (excerpted from WSJ article)

Another piece of good news is that November was the best month of stock market performance since 1987. Many analysts seem convinced that the vaccine news is already priced in and suggest that the real focus should turn to stimulus and what Jerome Powell and the Fed do moving forward.

Economic data and stimulus

The economic side is more of a mixed bag. The November Non-Farm Payroll (NFP) jobs report suggests that the labor market is running out of steam. The addition of 245,000 jobs is continues the trend of gains, but at a slowing pace when compared to months prior. State leaders are returning to the questions of retracting reopening plans and other types of precautionary measures for what is expected to be a horrifically grim winter as far as the virus is concerned. On a week-to-week level, the new jobless claims came in lower this week than previous weeks but is nothing definitive enough to lay claim to any longer-lasting trend.

Meanwhile, Jerome Powell and the Fed announced an ‘unlocked’ $2 trillion that can go toward further supporting the economy.

“In testimony prepared for delivery at a congressional hearing Tuesday, Mr. Powell said the Fed’s unprecedented steps to stabilize financial markets had largely succeeded in restoring the flow of credit from private lenders.” … Earlier Monday, the Fed said it had extended through next March four backstop lending programs that helped to stabilize short-term funding markets when the coronavirus pandemic hit this past spring. (excerpted from WSJ article)

It is nice to be seeing the Fed step up where Congress and Treasury Secretary Mnuchin have refused to. In interactions like these, it comes as no surprise that having just a basic understanding of economics separates those who know what is needed from those who don’t know what is needed.

“Mr. Mnuchin had indicated he would agree to extend four programs, including the Paycheck Protection Program Liquidity Facility, which made it more attractive for small banks to fund PPP loans this past spring. The Fed agreed to extend that program on Monday… The Fed also extended the Commercial Paper Funding Facility, which backed a critical market for short-term corporate IOUs that seized up this past March, and the Money Market Fund Liquidity Facility, which had likewise curtailed potential runs on money-market mutual funds.” (excerpted from WSJ article)

I would not be surprised to see the continuation of stimulus stumbles into the end of the year and into the next. Stay tuned here for any major breakthroughs.

A diet full of debt

An article by Christopher

Something that we’ve talked about in many different capacities is the growing debt load in different areas. We’ve discussed the impact of a growing government debt pile as well as the large projected loan losses from student loans. But something that is coming out from the low rate environment brought on by the pandemic is the rise of corporate debt issues.

American companies with investment-grade credit ratings have issued more than $1.4 trillion of debt this year, up 54% over the same period in 2019, Refinitiv data show. Issuers span companies, such as Apple Inc., which have been relatively unscathed by the coronavirus pandemic and others, such as aerospace giant Boeing Co. , which have been more seriously affected. Boeing sold $25 billion of bonds in the year’s biggest corporate deal. Among riskier borrowers, U.S. junk-bond issuance has soared 70% to $337 billion, Refinitiv data shows. American deals make up the majority of sub-investment-grade debt globally. Companies in industries hit hard by the economic effects of Covid-19, from Macy’s Inc. to cruise operators such as Carnival Corp. and Royal Caribbean International, have been able to tap the market. (excerpted from WSJ article)

It has been somewhat of an easy decision for corporates, though. Times of distress, especially in low-rate times, almost necessitate the issuing of more debt to stave off the dreaded bankruptcy filings.

This trend is not exclusive to the U.S. either. Many global economies are noting similar trends, with other national banks (like our Federal Reserve) have continued similar bond backstopping practices like ours to help keep propping up the debt-end of the economy. Even on the emerging market side debt use has increased as a countermeasure for economic downturns.

Debt is a double-edged sword. It helps stave off near-term troubles, but only if you can provide repayments when the debt comes due. We can only hope that does not manifest into a catastrophe down the line.

Bye-bor to LIBOR

An article by Christopher

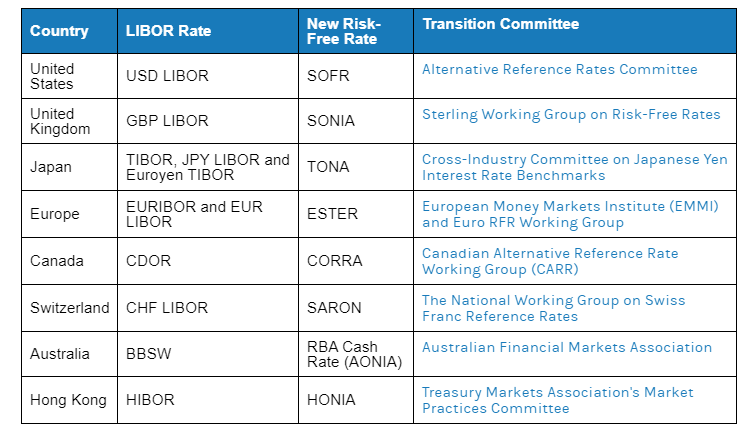

On the fixed income front, we got a phasing out timeline of LIBOR as the standard for overnight lending. LIBOR, or formally the London Interbank Offer Rate, has been around for a long time and stood as the main rate for overnight lending between banks.

Libor is calculated from an average of banks that participate in overnight lending to each other. The rate is critical for short-term funding that financial institutions use for their operations, but has seen controversy over the years… (excerpted from CNBC article)

In the announcement, banks will stop writing new contracts using LIBOR by the end of year 2021, and all existing contracts using LIBOR are to be completed and closed by mid-year 2023. The announcement comes after a longstanding investigation into LIBOR, which came to a head in 2012 after several large banks were caught manipulating the rate for profit.

The bigger challenge was not walking away from LIBOR, but instead finding an adequate and widely useable replacement for the legacy overnight rate.

The Fed has been warning banks to start preparing for a transition away from Libor to what is called the Secured Overnight Financing Rate, or SOFR. Instead of relying on bank quotes, SOFR will use rates that investors offer for bank securities such as loans and assets backed by bonds. (excerpted from CNBC article)

Morgan Stanley released a report a little over one year ago highlighting the transition from LIBOR to SOFR and highlighted the difficulties in simply exchanging one for another. Within the already existing contracts, the very nature of the arrangements would be altered if they swapped LIBOR for SOFR, which leads to having a ‘winding down’ and ‘winding up’ process for the rates. Additionally, leaving one widely accepted standard for a set of comparable replacements will also require time to adjust. Different large nations will be adopting their own LIBOR replacement, which will need time to be phased in.

Nevertheless, business in the overnight lending world will continue to be a cornerstone to banking and finance, regardless of which rate is being used. It will be interesting to see what happens more generally, as LIBOR was the underlying reference rate for many things, including corporate debt offerings, mortgages, and other securitized debt products. An established market for SOFR derivatives (for hedging purposes) will need to be established before we can tell how wide the impact of the rate change will be on things like bank profits and share performance.

Read more here.

The importance of building a personal brand

An article by Aman

A year ago, I would only post life updates to LinkedIn. Seriously – I thought that LinkedIn was nothing more than a notice board for your career because everyone else I was connected with was doing just that.

My perception of LinkedIn (and consequently, my personal brand) was heavily influenced by what I saw happening around me. But that all changed when I met Patrick. Patrick is also another international student, but I saw that he was using LinkedIn differently; truthfully, Patrick was using LinkedIn like millions of other people were using it – just not the millions I was connected with.

Patrick was posting regularly, sharing life lessons, struggles, perspectives, and opinions along the way. But more than that, Patrick was engaging in discussion with other “posters”. You see, for too long, I was just a long-time follower, one-time poster. However, when I began speaking with Patrick about how he saw LinkedIn, I realized that my life had an untapped stream of potential: my personal brand.

As an entrepreneur, it’s my job to market myself. My name isn’t attached with a big-name company that I can use to validate my legitimacy. My name is attached with a (relatively unproven) start-up, which is showing great potential.

By building my personal brand, I am able to take initiative on what I see as the biggest driver to modern digital growth: social media. While Instagram has been fantastic for our brand in terms of getting our products into as many hands as possible, LinkedIn serves a wholly different purpose. By regularly creating and posting content to LinkedIn, I am able to tear down the wall between Founder and Customer; therefore, making our brand a lot more approachable than a big box brand.

Simply put, I reveal everything about my entrepreneurial journey on LinkedIn for all to see. My followers know everything from the trademark issues we faced, the day we got into our first store, and everything in between. LinkedIn allows me to show vulnerability that other platforms cannot, and that’s why it’s so powerful.

Building a personal brand will be one of the best things you do. If you don’t know where to start, here’s a prompt: share a story and how it changed the way you see the world.

Quick Takes

To fill in the gaps

Snowflake unveils a star-studded first earnings report as a public company. (via CNBC)

A helpful video explaining the rise in Options popularity. (via WSJ)

It looks like Bill Gates was right about the business travel thing. (via WSJ)

Ford delays new Bronco until 2021. (via CNBC)

Airbnb is looking to raise $2.5 billion in upcoming IPO. (via FT)

Salesforce announces purchase of Slack for $27.7 billion. (via NY Times and Axios)

NASDAQ looks to implement a new board of directors’ gender diversity rule. (via WSJ)

Moderna asks FDA for emergency authorization for their COVID 19 vaccine. (via WSJ)

U.S. will remove nearly all troops from Somalia. (via WSJ)

S&P Global acquires IHS Markit for $44 billion. (via WSJ)

COVID 19 continues to reshape the future labor market. (via WSJ)

OPEC’s oil outlook. (via WSJ)

Southwest warns of more furloughs to employees. (via CNBC)

City setbacks for return to office life. (via WSJ)

General Banter

What’s on the minds of our editors and writers

I put enough banter about COVID 19 in today’s edition up at the top, so I will take a break from the banter this week.

Reader’s Corner

A place for suggestions for readers like you

The reader should not work too hard this weekend, shoveling in the first nor’easter of the season! Check back in next week for new suggestions.

Well done. You’ve made it through the madness. I’ve worked hard to ensure that you leave this page having learned something, and I hope that it benefits you in your daily adventure. Thank you again for checking in.

Do you like what you have read? Consider subscribing so that Market Madness is hand-delivered to your inbox each day! If you know of anyone missing Market Madness, save them the trouble, and share it with them!

Where is ‘Behind the Madness’?

I have moved “Behind the Madness” to this clickable button. Find all the original links, signups, and even more each week appended to that week’s edition of Market Madness with the other buttons below the Reader’s Corner.