What’s new

Administrative topics and an introduction

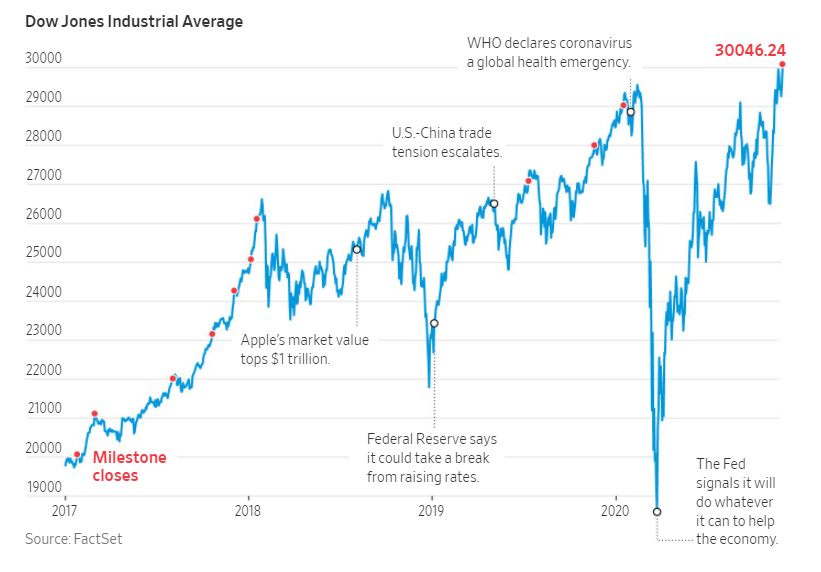

Well folks, another highlight week. We saw the Dow Jones Industrial Average surpass 30,000 for the first time. Although we did not end the week above 30,000, it is still worth celebrating the milestone (as long as we don’t crash hard on Monday). COVID 19 is still in full force in the states and overseas, putting considerable downward pressure on market optimism. It does not seem to be stopping the markets from their upward trajectory, at least not yet.

Today’s issue is going to be pretty standard. We’re going to walk through some market and economic news, and wrap up with oil projections.

Did you miss the last edition? No worries! Get it right here and catch up on the madness. Consider subscribing down at the bottom of this newsletter so you never miss another edition and read from the comfort of your inbox.

In the meantime, if you are interested in my thought process throughout the week as we collect news and ideas for the Sunday publication, please check out my Walling page where we brainstorm and mind-map each week’s edition!

Fundamentals

Where did the markets end last week?

U.S. Indices 5 Day Performance

Dow Jones: +2.25%

S&P 500: +2.30%

NASDAQ: +2.97%

Asia and Europe 5 Day Performance

Nikkei 225: +4.38%

Hang Seng: +1.68%

FTSE 100: +0.34%

DAX: +1.51%

Rates, Spot Prices, and ‘Good to Knows’

U.S. Dollar Index: 92.39

US 10 YR: 0.846%

Crude OIL: $45.52

Spot Gold: $1,787.50

Market Madness Portfolio: +17.25% YTD

TEDRATE: 0.13

LIBOR (3 month): 0.224%

COVID 19 Global Cases: 62,393,754 (updated Nov. 29, 2020)

Weekly update

An article by Christopher

Financial Markets

U.S. markets performed well on the week, collecting steam from vaccine optimism and record setting highs. Investors found the 30,000 milestone on the Dow Jones to be something of remarkable merit for the stock market rally. We’re also seeing volatility trend back down toward lower levels, suggesting that there is a rising calm in the markets. Many are seeing the reduction in volatility, measured in the VIX, as a sign that the roughest road from the COVID-19 market impact may be behind us. In other words, some market experts are seeing some clarity where there was none before.

The Fear and Greed Index points to a current market labeled by “extreme greed.” Investors appear to be taking any opportunity they can to focus on the good and avoid the bad. A lot of the long-term success is going to be determined on the economic recovery, not necessarily the boost seen in the stock market.

Economic Data

On the economic side, we are starting to see some stagnation. Jobless claims jumped for the second week in a row on the heels of several declining weeks. A major sign of optimism for investors were the declining jobless claims. We are, however, approaching a new challenging decision for state leaders as the rising COVID-19 cases pose a threat for more spreading. Elsewhere, consumer spending in October rose, but at a slower pace compared to previous months. On the other side of the coin, with respect to why the rise in consumer spending was so low compared to months before, is the sharp decline in personal income. Personal income being down is likely a byproduct of the increasing jobless claims and the decline in the enhancements made to unemployment benefits.

It would come as no surprise that many market watchers were hoping for a large spending jump with Black Friday, but given the increased restrictions and shortened shopping times, it is unlikely that we will see a record spending holiday. This is only a speculation, of course. It will be interesting to see what the report on Black Friday spending for 2020 looks like in a few weeks.

Crude Oil

In commodities, oil still remains a tense topic. ExxonMobil has lowered their oil price expectations for the next 7 years anywhere from 11 to 17% each year. It comes as no surprise that COVID-19 has entirely disrupted the energy sector, particularly crude oil. These price guidance adjustments suggest that we might continue to see lower gasoline and home heating oil prices for some years still. In the past week, crude prices moved back up into the mid-$40s per barrel, but still low in comparison to where the year began, which was in the ballpark of $60ish per barrel.

As a globe, we’ve seen some of the environmental positives to reducing our carbon footprint during the COVID-19 months. There are considerable moves into electric vehicles by big and small players in the EV space, and the same technology could come to power homes as well. There is a lot of work to be done in this space, but I feel strongly that this is the direction we’re heading for a more sustainable and ecological future.

Quick Takes

To fill in the gaps

Former Zappos CEO, Tony Hsieh, dies at 46. (via WSJ)

Donnie finally allows for transition processes to begin. (via WSJ)

Biden picks foreign policy team. (via CNBC)

Top Iranian nuclear scientist assassinated. (via CNBC)

Airlines look to tech to solve COIVD-19 testing and flying. (via FT)

Biden calls on Janet Yellen to serve as his Treasury Secretary. (via CNBC)

More on COVID-19’s Black Friday. (via CNBC)

The latest on London and Brexit. (via FT)

Bitcoin is back? (via WSJ)

These COVID-19 vaccines won’t be a breeze to take. (via CNBC)

GE deepens aviation cuts. (via WSJ)

Salesforce in talks to acquire Slack Technologies. (via WSJ)

More on Tesla’s S&P 500 debut. (via WSJ)

General Banter

What’s on the minds of our editors and writers

You can find more on the Dow’s historic 30,000 day here.

Reader’s Corner

A place for suggestions for readers like you

The reader might enjoy checking out Multiple Expansion and their library of detailed resources for finance professionals.

Do you like what you have read? Consider subscribing so that Market Madness is hand-delivered to your inbox each day! If you know of anyone missing Market Madness, save them the trouble, and share it with them!

Behind the Madness

Well done. You’ve made it through the madness. We’ve worked hard to ensure that you leave this page having learned something, and we hope that benefits you in your daily adventure. Thank you again for checking in.

Publishing Schedule: every Sunday

Connect with Market Madness

Some Sign-ups

These are worth your time

Atom Finance: “Atom’s platform offers an ever-growing arsenal of powerful research and portfolio monitoring tools to anyone…” Sign up for a FREE account here.

Robinhood Sign Up: You get a stock, and you and you and you, and me! Follow my Robinhood link (if you’ve not signed up before) and we both get a randomly picked stock! A great way to get a jump start on investing, especially if you are hesitant to invest your own money at first. Your free stock is waiting for you here.

Koyfin: Financial websites have basic data and are cluttered with advertisements. Professional tools like Bloomberg are awfully expensive and difficult to use. Koyfin was created to provide investors with affordable and intuitive analytical tools to research stocks and understand market trends. Read more and join for FREE here.

TOGGLE: TOGGLE puts hedge-fund grade analytics within reach of every investor. Sign up for a FREE account here. Also, grab a FREE daily briefing for some tickers here.

Dirty Dozen Chart Pack (from Macro Ops): Good intelligence is vital. Great intelligence is priceless… Sign up to receive my weekly chart pack of the twelve most important and actionable charts that’ll make sure you kick your week off right. Sign up here.

Morning Brew: Become smarter in just 5 minutes. Get the daily email that makes reading the news enjoyable. Stay informed and entertained, for free. Sign up here. Grab their other, new, newsletters too: Emerging Tech Brew, Retail Brew, and Marketing Brew.

Investor Amnesia: a cool new email distribution for “your financial history fix through reading my articles, or those that I link to in my weekly ‘Financial History: Sunday Reads’.” Sign up here.

Axios News Sign Up: News worthy of your time. Get newsletters featuring news, scoops & expert analysis by award-winning Axios journalists like Mike Allen, Dan Primack and Ina Fried. View and sign up for their newsletters here.

The Hustle: Bold business and tech news. We cut through the noise with the most impactful headlines. Sign up here.

Wall Street Breakfast: Wall Street Breakfast, Seeking Alpha's flagship daily business news summary, is a one-page summary that gives you a rapid overview of the day's key financial news. Get today’s piece here.

The Water Coolest: The Water Coolest is a daily business news and professional advice email newsletter for young professionals. Biz news. Financial advice. Unfiltered commentary. One daily email. In 5 minutes or less. Sign up here.