What’s new

Administrative topics and an introduction

Well folks, another week is behind us. A lot of the conversational topics from the week before continue to haunt us; COVID 19, finalizing election counting, and an attentive focus of the fed and the economic recovery. The biggest news of the week was the breakthrough by Pfizer in their vaccine trails which moved markets and left “stay-at-home” tech stocks down in the dumps. We’re still a long, long way away from a vaccine that can be distributed en-mass, but it is always good to hear about forward progression. Let’s get into the news.

Did you miss the last edition? No worries! Get it right here and catch up on the madness. Consider subscribing down at the bottom of this newsletter so you never miss another edition and read from the comfort of your inbox.

In the meantime, if you are interested in my thought process throughout the week as we collect news and ideas for the Sunday publication, please check out my Walling page where we brainstorm and mind-map each week’s edition!

Fundamentals

Where did the markets end last week?

U.S. Indices 5 Day Performance

Dow Jones: +4.19%

S&P 500: +2.21%

NASDAQ: -0.53%

Asia and Europe 5 Day Performance

Nikkei 225: +4.37%

Hang Seng: +1.77%

FTSE 100: +7.04%

DAX: +4.78%

Rates, Spot Prices, and ‘Good to Knows’

U.S. Dollar Index: 92.76

US 10 YR: 0.895%

Crude OIL: $40.12

Spot Gold: $1,889.40

Market Madness Portfolio: +14.15% YTD

TEDRATE: 0.11

LIBOR (3 month): 0.221%

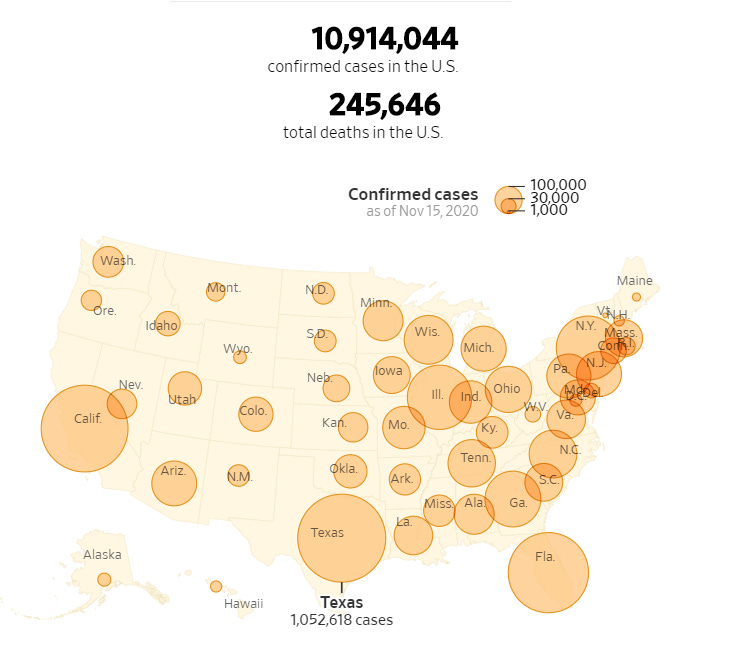

COVID 19 Global Cases: 54,127,451 (updated Nov. 15, 2020)

Weekly update

An article by Christopher

COVID chronicles

At the current moment, we’re in what I would consider to be a financial and economic holding pattern. As mentioned before, the vaccine news is great, but the continued wait for approval, distribution, and mass-vaccination will be a long one. In the meantime, cases are skyrocketing across the U.S. and overwhelming hospitals and other treatment facilities. Americans seem to fear the threat of quarantining and restrictions rather than the virus itself as both citizens and leaders try to find alternatives to lockdowns.

Of course, this is a generalization, and those are always dangerous. But from my experiences thus far, I’m seeing many more people out and about, despite the worsening case-conditions. People have seemed to hit COVID-fatigue and lockdown-fatigue, looking just to get out and get back to normal in a world that is still anything but.

The good news is that the scientific community is on the verge of a lifesaving breakthrough that will hopefully bring about an end to the uncontained spread of the virus. Scientists and health experts still suggest that, even with a vaccine, the return to fully normal life will be a long and winding road.

Financial market recap

On a rosier note, financial markets performed well this week, adding to the gains from the week before (except for the tech sector). Investors appear to have moved on from the election-anticipation of the week before and back focusing solely on the pandemic. A big rally for industrials and travel stocks took place following Pfizer’s announcement and a selloff on those “stay-at-home” stocks, which was something we’d seen previously on positive vaccine news. Investors finally woke up and smelled the coffee, realizing that great news is not immediately actionable, and things calmed down for the remainder of the week. Of course, the increasing case counts for the virus across the U.S. is taking a toll on investor’s optimism regarding the ongoing recovery effort. As for the major headlines, all the news is mixed and muddied. We go up and down between optimism and pessimism like a child who can’t make up their mind at a restaurant.

Elsewhere, we saw overseas indices perform really well, in line with positive vibes regarding the vaccine developments. Crude oil broke back above $40/barrel to end the week and we saw gold retract back under $1900/ounce. Both U.S. 10 year and 3-month LIBOR saw a slight increase, signaling (as we know their inverse price-yield relationship) risk-taking behavior by investors, as they look to sell out of bonds and buy into stocks.

As for the economic situation…

It should not come as a surprise that Jerome Powell and the Fed are continuing their attentive gaze on the pandemic as it relates to the U.S., and global, economy. There are lots of concerns in this domain, both in short-term recovery, as well as longer-term implications.

“Specifically, [Powell] cited women out of work involuntarily, children whose education is suffering and small business owners who have lost ‘generations of intellectual capital.’” (excerpted from CNBC article)

I tend to believe that Powell is right here, we’ve lost a lot more than we think we have, and we’ll end up bracing the consequences for generations to come. Fundamentally, businesses have had to change so much to stay alive in these times, from supply chain alterations, to supplemental training for new employees onboarding virtually, to migrating from an office experience to a virtual one, the list goes on and on. As businesses change, so too does the economy, and it will be really interesting to see what economic alterations will be made coming out of a pandemic-focused economic system.

Elsewhere, weekly jobless claims fell for another week, signaling some recovery being realized in the labor market. Claims came in at 709,000 versus the estimated 740,000 by Wall Street analysts. Zooming out, “…more than 21 million Americans are still collecting benefits, though the total is declining gradually.” (excerpted from CNBC article). There is still economic work to do, but we’re making gradual progress.

Quick Takes

To fill in the gaps

Pfizer CEO dumps shares after major vaccine announcement. (via CNBC)

Upcoming DoorDash IPO optimism rises after strong quarterly results. (via WSJ)

GM to expand hiring as it dives deeper into tech expertise. (via WSJ)

Donnie sends Defense Secretary packing. (via CNBC)

What impact does a vaccine have on investments in stock sectors? (via FT)

Disney shares performed well after “not as bad” Q4 results. (via CNBC)

More on Biden plans. (via WSJ)

Investors dive into SPACs — higher risk, higher return potential. (via WSJ)

The rush to stocks. (via FT)

General Banter

What’s on the minds of our editors and writers

The editors have decided to let the banter go this week, and we’ll return soon!

Reader’s Corner

A place for suggestions for readers like you

The reader might enjoy the quick weekly recap from the research team over at Darqube. Check that out here.

Do you like what you have read? Consider subscribing so that Market Madness is hand-delivered to your inbox each day! If you know of anyone missing Market Madness, save them the trouble, and share it with them!

Behind the Madness

Well done. You’ve made it through the madness. We’ve worked hard to ensure that you leave this page having learned something, and we hope that benefits you in your daily adventure. Thank you again for checking in.

Publishing Schedule: every Sunday

Connect with Market Madness

Some Sign-ups

These are worth your time

Atom Finance: “Atom’s platform offers an ever-growing arsenal of powerful research and portfolio monitoring tools to anyone…” Sign up for a FREE account here.

Robinhood Sign Up: You get a stock, and you and you and you, and me! Follow my Robinhood link (if you’ve not signed up before) and we both get a randomly picked stock! A great way to get a jump start on investing, especially if you are hesitant to invest your own money at first. Your free stock is waiting for you here.

Koyfin: Financial websites have basic data and are cluttered with advertisements. Professional tools like Bloomberg are awfully expensive and difficult to use. Koyfin was created to provide investors with affordable and intuitive analytical tools to research stocks and understand market trends. Read more and join for FREE here.

TOGGLE: TOGGLE puts hedge-fund grade analytics within reach of every investor. Sign up for a FREE account here. Also, grab a FREE daily briefing for some tickers here.

Dirty Dozen Chart Pack (from Macro Ops): Good intelligence is vital. Great intelligence is priceless… Sign up to receive my weekly chart pack of the twelve most important and actionable charts that’ll make sure you kick your week off right. Sign up here.

Morning Brew: Become smarter in just 5 minutes. Get the daily email that makes reading the news enjoyable. Stay informed and entertained, for free. Sign up here. Grab their other, new, newsletters too: Emerging Tech Brew, Retail Brew, and Marketing Brew.

Investor Amnesia: a cool new email distribution for “your financial history fix through reading my articles, or those that I link to in my weekly ‘Financial History: Sunday Reads’.” Sign up here.

Axios News Sign Up: News worthy of your time. Get newsletters featuring news, scoops & expert analysis by award-winning Axios journalists like Mike Allen, Dan Primack and Ina Fried. View and sign up for their newsletters here.

The Hustle: Bold business and tech news. We cut through the noise with the most impactful headlines. Sign up here.

Wall Street Breakfast: Wall Street Breakfast, Seeking Alpha's flagship daily business news summary, is a one-page summary that gives you a rapid overview of the day's key financial news. Get today’s piece here.

The Water Coolest: The Water Coolest is a daily business news and professional advice email newsletter for young professionals. Biz news. Financial advice. Unfiltered commentary. One daily email. In 5 minutes or less. Sign up here.