What’s new

Administrative topics and a general market recap

Well folks, another week full of twists, turns, and market movements is behind us. We are approaching another critical moment in the global fight against COVID 19, as cases are spiking both in the U.S. and across Europe. Public health experts are calling for increased diligence and precautionary efforts from everyone going into what is expected to be a difficult and deadly winter. Cases here in the U.S. have hit all-time new highs on a day to day view as well as on a moving 7-day average view. Rising cases are becoming a returning focus on the news outlets as well as within financial markets. Please do your part and help keep everyone safe.

This edition is really special to me. My good friend and former Bentley University classmate Aman Ailani has joined the Market Madness team! He will be brining us through his journey starting his own cold-brew coffee company and what it takes to be an entrepreneur this day in age.

Next edition is going to be a little delayed, will likely be published on Monday or Tuesday. I’m anticipating a news-filled week and I want to take my time with this one.

Let’s get into the news.

Did you miss the last edition? No worries! Get it right here and catch up on the madness. Consider subscribing down at the bottom of this newsletter so you never miss another edition and read from the comfort of your inbox.

In the meantime, if you are interested in my thought process throughout the week as we collect news and ideas for the Sunday publication, please check out my Walling page where we brainstorm and mind-map each week’s edition!

Fundamentals

Where did the markets end last week?

U.S. Indices 5 Day Performance

Dow Jones: -6.47%

S&P 500: -5.62%

NASDAQ: -5.50%

Asia and Europe 5 Day Performance

Nikkei 225: -2.28%

Hang Seng: -3.26%

FTSE 100: -4.80%

DAX: -8.61%

Rates, Spot Prices, and ‘Good to Knows’

U.S. Dollar Index: 94.04

US 10 YR: 0.879%

Crude OIL: $35.72

Spot Gold: $1,877.90

Market Madness Portfolio: +6.10% YTD

TEDRATE: 0.12

LIBOR (3 month): 0.214%

COVID 19 Global Cases: 45,715,640 (updated Oct. 31, 2020)

Weekly update

an article by Christopher

You could guess the big talking points that we’ll cover in this weekly update, but they’re still as important as ever. COVID 19 cases are way up everywhere, bringing about more concern within financial markets. This week felt a lot like March when looking at the weekly performance of the U.S. indices. Coupled with rising cases, stimulus developments seem to be a lost hope, at least as far as 2020 is concerned.

Overall, it was a down week, with some really bad days and some less bad days. The same is true when looking overseas as well, both at the European and the Asian markets. Looking at October as a whole, it was not a good month for stock performance. Despite the stock market performance, the economy is sending mixed signals. Weekly jobless claims fell to just above 750,000 which is low compared to previous weeks. Additionally, the report on Q3 GDP showed a great deal of recovery during the quarter; we saw 33.1% increase in the quarter. This is expected as we moved down in the phases of reopening, people got back to work, and we saw a steep increase in stock market indices. Now with the rising cases, and the lockdowns going into place in Europe, it seems unlikely that we will continue the same trajectory for Q4.

As far as the Fed is concerned, their window of opportunity is quickly closing given the immobility of Congress to reach a deal. For some time now, the Fed has acted on their end to provide market and economic stability, but have reiterated that only so much can be done solely from them. Now, and for some time now, the ball has been in Congress’ court to provide some action. It looks like they’ve lost the ball within their court on this one. The next time the Federal Open Market Committee (FOMC) meets is on November 4th and 5th, immediately following the election. This will be a pivotal meeting for that group, as they will have big questions to try and answer regarding future outlooks and near-term economic conditions.

McRib effect

an article by Christopher

Let’s take a step back from all the serious financial and political talk for a moment and try to enjoy the small things in life, like this sammy here:

Now, I’ve never had the McDonald’s McRib, but I know my middle and high schools offered their take on it as a weekly lunch option. It was likely the same mystery meat concoction and bun, but my school lacked the finesse of the pickles and onions. Yes I know this is the publicity photo and like all menu items, and most celebrities, the McRib will not look the same and (as far as food is concerned) often much worse. (Have fun googling the menu vs. reality of the McRib)

“Starting Dec. 2, McDonald’s McRib is returning to menus nationwide for the first time since 2012.” (excerpted from CNBC article)

Now, if you’ve gotten this far, you’re wondering why this is even coming up. No, I am not intentionally trying to damage my journalistic integrity by doing a McRib ad (no sponsorships here, I am not as cool as Travis Scott). However, the McRib has had its hand in the financial world.

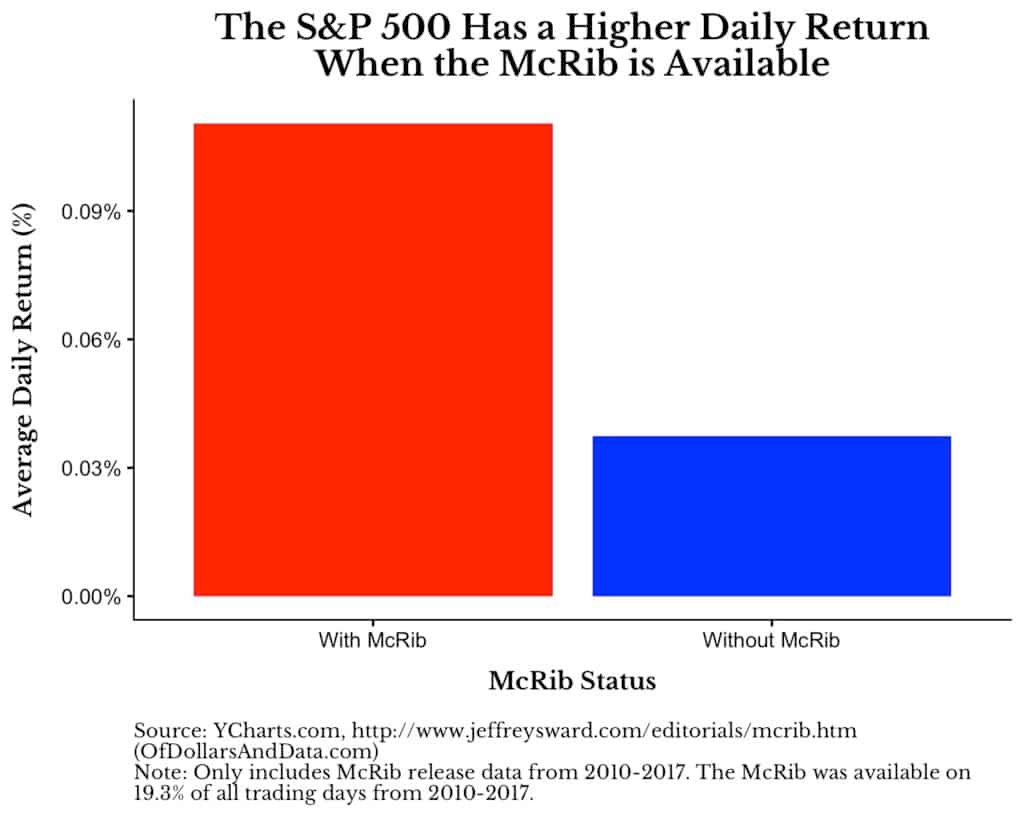

“Every year since 2010, McDonald’s re-releases its pork-based sandwich, the McRib, for a limited time across the U.S. After hearing that the McRib was being re-released on October 29, 2018, I immediately wondered whether the McRib’s availability had any affect on the stock market.

I found some historical re-release dates online, ran the numbers, and discovered I was right:” (excerpted from Of Dollars and Data newsletter article)

What this graph is telling us is that when the McRib is available, the S&P 500 tends to yield higher daily average returns (by 0.07% or 7 basis points) than when it is not available. Nick Maggiulli, the author of the piece goes on to say, “to put that into perspective, when annualized, that difference would be 19% every year.”

“Woah woah woah”, you must be thinking to yourself. Either you think I am crazy for even sharing this, or that Nick is really up to something here. Let me add some more of his article for you here for context. This is his answer to the “does this even really matter or make a meaningful difference?”

“The first thing I did was run a t-test on the difference in returns between when the McRib is available and when it isn’t. Unsurprisingly, the difference was not statistically significant (p-value = 0.19). Afterwards, I ran 10,000 simulations in which McDonalds re-released the McRib at different times throughout 2010-2017 for the same number of total days and then compared to see how many simulations showed results as extreme as the real world.

After running the simulations, only 4.6% of them had the McRib days outperforming the non-McRib days by over 0.07%, on average. This might make the McRib Effect seem more plausible, but I also found that 4.2% of the simulations had the non-McRib days outperforming the McRib days by over 0.07%, on average. This is the exact opposite of what I was looking for.

While you might laugh at the McRib Effect as an obvious example of “correlation does not equal causation,” I don’t see how it is that different from a lot of the arguments I see being made about financial markets every single day. Some pundit will claim that event X caused the market to drop or how President A was better than President B for stocks.” (excerpted from Of Dollars and Data newsletter article)

So is the McRib effect all that it was cracked up to be? Well, likely not. However, the important takeaway from this is to wonder how this correlation vs. causation debate is any different from what we attribute to the financial markets on a daily basis as Nick mentions in the tail-end of the quote above. But there are some true instances of news and world events that do shake up financial markets. Those are completely valid. I suppose the real question, then, is how far are you willing to go to make the events line up?

Special Release: Journey in Entrepreneurship so Far

an article by Aman Ailani

My name is Aman Ailani and I’m the founder of SAH.OL [sah-hole] Cold Brew. I’m a recent graduate from Bentley University with a degree in Business Management. I also played on the Men’s Golf Team and worked as my college mascot (true story).

I started SAH.OL because of a rough experience I personally had with ready-to-drink coffee. Being born and raised in Dubai, I was surrounded by a vibrant coffee culture. Dark roast coffees, Arabian coffee pots, and the sweet smell of dates fill the corners of every home I was in. However, I never took an interest in coffee until my freshman year at Bentley.

One night, I was staying up late trying to finish studying for my midterms, and I needed an energy boost. Given that all coffee shops on campus were closed, I walked over to the vending machine and grabbed a “frappe-type” coffee and took it back to my seat. After just a couple sips, I realized that it was more sugar than coffee, and sure enough, I had a sugar crash.

From a young age, I have naturally been entrepreneurially-minded, so shortly after this experience, I decided to figure out a solution for this problem. At the time, there were a few canned coffees, but I found problems with that too – they were either too darkly roasted (producing a bitter taste) or they were doused in sugar, bringing me back to my original problem. The summer after my freshman year, I purchased a Cold Brew maker and started visiting local roasters around me. I spent the following 3 years learning all I could about craft coffee, and I realized the scope and depth of the market.

Upon graduating from Bentley University, I put my ideas down on paper and formally incorporated my company. While it was a wild ride over the summer, things fell into place and in October of 2020, we entered our first retail store. At the time of writing, we are currently in 10 stores across Massachusetts, with more coming in the rest of the year and into 2021.

The future looks bright!

Quick Takes

To fill in the gaps

Tesla hiding legal claims? (via CNBC)

RIP value investing? (via FT)

France and Germany announce new lockdown procedures to combat rising COVID 19 cases. (via WSJ)

AMD purchasing its competitor in $35 billion deal. (via WSJ)

Spy games. (via WSJ)

Big tech, big earnings. (via WSJ)

AIG to sell its life insurance arm. (via WSJ)

Antitrust strikes against Visa for proposed purchase of Plaid. (via WSJ)

Arby’s parent in talks to purchase Dunkin’ Brands. (via WSJ)

U.S. Senate pushes through new SCOTUS nominee. (via FT)

More on the Ant Group IPO. (via WSJ)

What did we learn from the first COVID 19 sports season? (via WSJ)

Who’s looking at bitcoin and crypto right now? (via WSJ)

Netflix ups the price. (via CNBC)

Get the latest on COVID 19 here. (via WSJ)

What’s on the minds of our editors and writers

Please go out and vote. Everyone’s voice needs to be heard, particularly given our current political and social climate. It will be an interesting week, given the election on Tuesday.

Reader’s Corner

A place for suggestions for readers like you

The reader might enjoy taking a self care weekend.

Do you like what you have read? Consider subscribing so that Market Madness is hand-delivered to your inbox each day! If you know of anyone missing out on Market Madness, save them the trouble and share it with them!

Behind the Madness

Well done. You’ve made it through the madness. We’ve worked really hard to ensure that you leave this page having learned something, and we hope that benefits you in your daily adventure. Thank you again for checking in.

Publishing Schedule: every Sunday

Connect with Market Madness

Some Sign-ups

That are definitely worth your time

Atom Finance: “Atom’s platform offers an ever-growing arsenal of powerful research and portfolio monitoring tools to anyone…” Sign up for a FREE account here.

Robinhood Sign Up: You get a stock, and you and you and you, and me! Follow my Robinhood link (if you’ve not signed up before) and we both get a randomly picked stock! A great way to get a jump start on investing, especially if you are hesitant to invest your own money at first. Your free stock is waiting for you here.

Koyfin: Financial websites have basic data and are cluttered with advertisements. Professional tools like Bloomberg are very expensive and difficult to use. Koyfin was created to provide investors with affordable and intuitive analytical tools to research stocks and understand market trends. Read more and join for FREE here.

TOGGLE: TOGGLE puts hedge-fund grade analytics within reach of every investor. Sign up for a FREE account here. Also, grab a FREE daily briefing for some tickers here.

Dirty Dozen Chart Pack (from Macro Ops): Good intelligence is vital. Great intelligence is priceless… Sign up to receive my weekly chart pack of the 12 most important and actionable charts that’ll make sure you kick your week off right. Sign up here.

Morning Brew: Become smarter in just 5 minutes. Get the daily email that makes reading the news actually enjoyable. Stay informed and entertained, for free. Sign up here. Grab their other, new, newsletters too: Emerging Tech Brew, Retail Brew, and Marketing Brew.

Investor Amnesia: a cool new email distribution for “your financial history fix through reading my articles, or those that I link to in my weekly ‘Financial History: Sunday Reads’.” Sign up here.

Axios News Sign Up: News worthy of your time. Get newsletters featuring news, scoops & expert analysis by award-winning Axios journalists like Mike Allen, Dan Primack and Ina Fried. View and sign up for their newsletters here.

The Hustle: Bold business and tech news. We cut through the noise with the most impactful headlines. Sign up here.

Wall Street Breakfast: Wall Street Breakfast, Seeking Alpha's flagship daily business news summary, is a one-page summary that gives you a rapid overview of the day's key financial news. Get today’s piece here.

The Water Coolest: The Water Coolest is a daily business news and professional advice email newsletter for young professionals. Biz news. Financial advice. Unfiltered commentary. One daily email. In 5 minutes or less. Sign up here.

DISCLAIMER ON SIGNUPS: I am not sponsored by any of these sites, companies, or individuals.

GENERAL DISCLAIMER: All rights reserved to respective sources where I pull my information. I do not own or have vested interests in the websites where I get my news and information. Links are provided as credit and to provide additional context where reader’s might want more information outside of what is printed here on these sheets.