Well that all happened really quickly

Administrative topics and a general market recap

Well folks, it has been a tidal wave of a week in every respect. Much of the week became lost the second Donnie told the world he’s got COVID 19 but don’t be fooled, there was a lot of other things that happened this week. We started the week scratching our heads at two adults fight in a sandbox during the first presidential debate, and we ended the week a little more confused about what the rest of the year holds.

U.S. indices did well this week, closing out Q3 with some considerably large gains. Asia was down and Europe was up on the week. Energy is still a weak spot when looking across market sectors. Airlines are cutting furloughed employees and crude oil has gone below $40/barrel again, both of which suggest that energy demand is going to have a long road ahead if it wants to get back to pre-covid levels. Despite the gloomy outlook in the industry, that has not stopped firms looking to conduct business ventures at relatively cheap levels. Shale producers Devon Energy and WPX Energy announced a merger this week.

Elsewhere, the USD index ($DXY) declined on the week, in sentiment with the bad geopolitical news with Donnie and such. The uncertainty resulting from that led to a rise in value of gold as well.

Here are some general themes that we will cover off on in this edition:

Debt and Macroeconomics

Jobs and Consumer Spending

Did you miss the last edition? No worries! Get it right here and catch up on the madness. Consider subscribing down at the bottom of this newsletter so you never miss another edition and read from the comfort of your inbox.

In the meantime, if you are interested in my thought process throughout the week as I collect news and ideas for the Sunday publication, please check out my Walling page where I brainstorm and mind-map each week’s edition!

Fundamentals

Where did the markets end last week?

U.S. Indices 5 Day Performance

Dow Jones: +1.87%

S&P 500: +1.54%

NASDAQ: +1.48%

Asia and Europe 5 Day Performance

Nikkei 225: -0.75%

Hang Seng: -1.19%

FTSE 100: +1.02%

DAX: +1.76%

Rates, Spot Prices, and ‘Good to Knows’

U.S. Dollar Index: 93.81

US 10 YR: 0.698%

Crude OIL: $37.01

Spot Gold: $1,898.70

Market Madness Portfolio: +8.30% YTD

TEDRATE: 0.12

LIBOR (3 month): 0.234%

COVID 19 Global Cases: 34,952,349 (updated Oct. 4, 2020)

Economic Update

Since this week was calm with respect to the level of market-specific news, we will take the time to assess the economic conditions as we enter Q4 2020. First, let’s start with jobs.

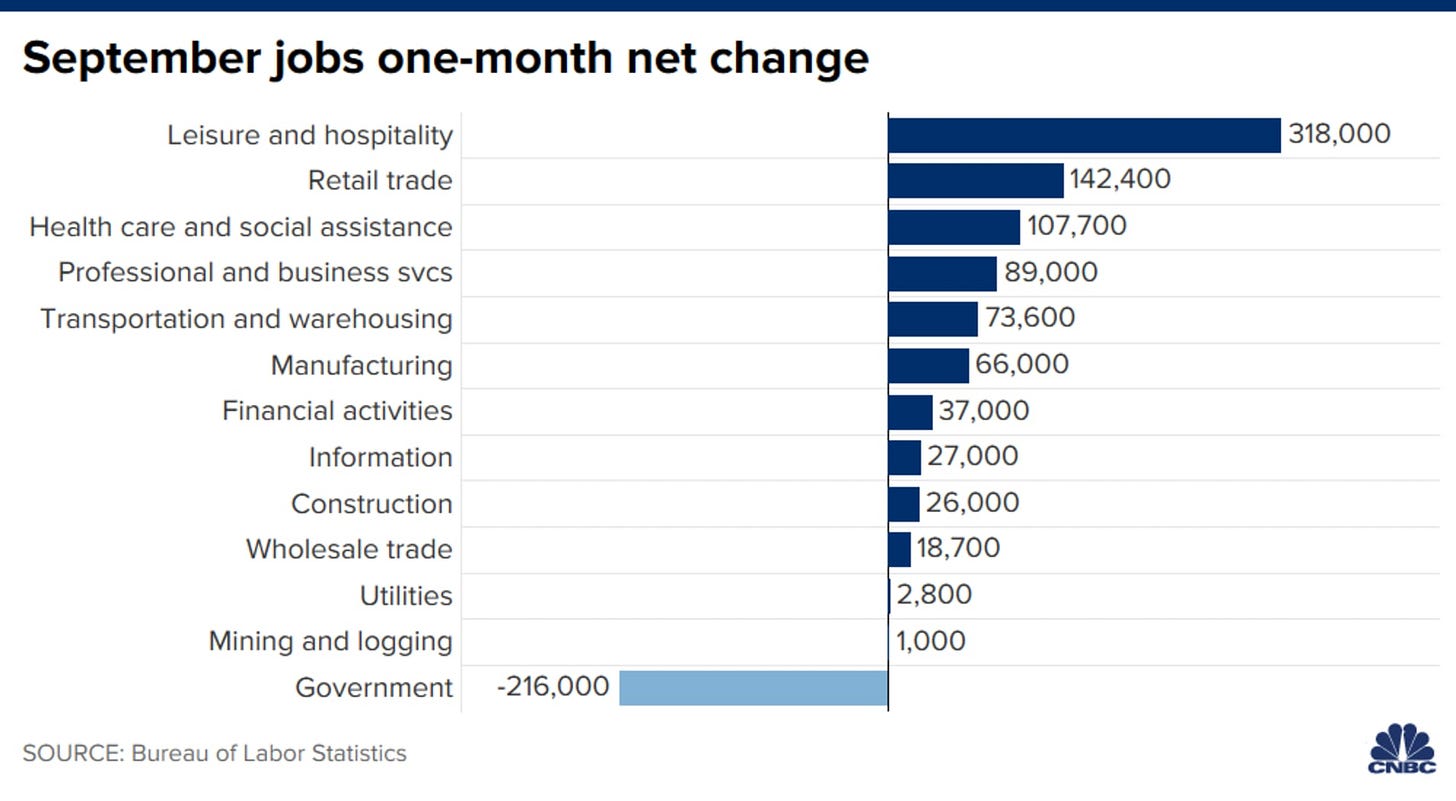

In September, we closed out Q3 with a below expected jobs report for the month. The economy added 661,000 new jobs which is well below the Wall Street expectation of 800,000. Despite the disappointing number, the total level of unemployment fell below 8% (now, we sit at 7.9%). Below is the breakdown of which industries gained and lost jobs in September.

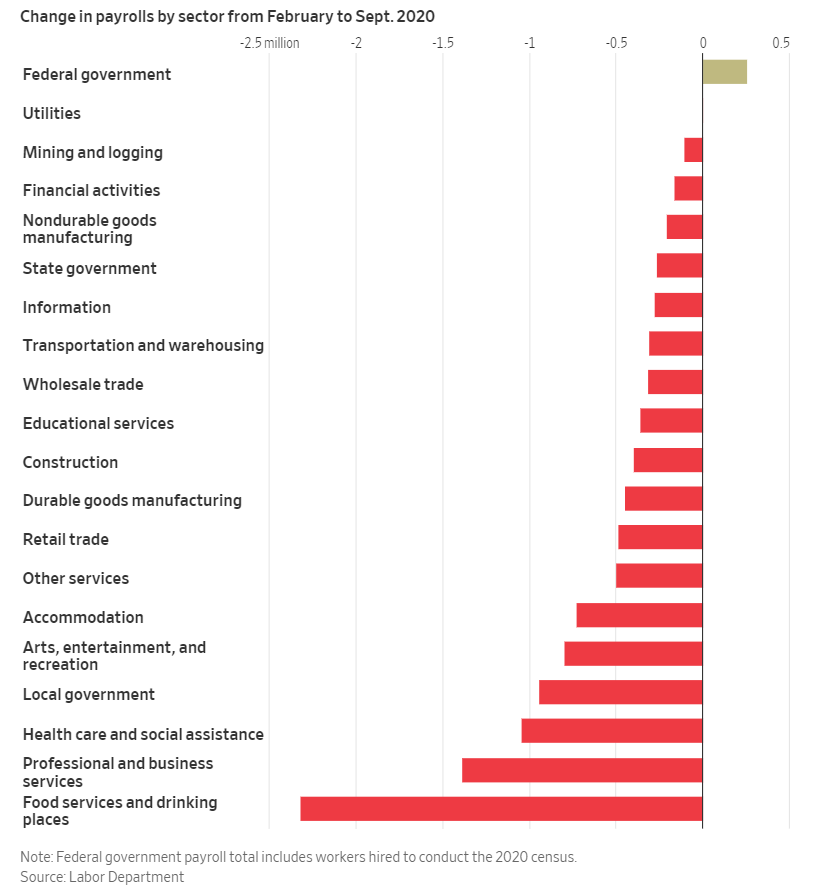

Looking at the bigger picture, here is where all the industries stand since February when 2020 really started to go downhill.

As we can see, there is still an incredibly large amount of work that needs to be done to get back to where we started. Luckily, we all understand (or should understand) that this won’t be fixed overnight and that we need to get the virus under control before we can fully reopen industries. As we have discussed before, it will be essential to follow these jobs reports in the months and even years to come as it is still unknown how many of these job losses will turn permanent and not just temporary for state closures.

Another area of economic data that is important to watch is consumer spending and income. The August personal income report showed a 2.7% decline which is being partially attributed to the reduction in enhanced unemployment benefits. Despite the shrinking benefits, workers are still left with little choice if their business is closed and new unemployment files still hover around 800,000 each week. The Labor Department totals 12 million workers on regular state unemployment programs across the states.

Consumer spending showed a little increase throughout the Summer months, but still remains depressed below pre-covid levels, another challenge for the economy as we look ahead. However, the biggest elephant in the room that we need to take time to discuss is the major debt levels that exist within the U.S. even before COVID 19 took over. That’s our next story.

Read more here, here, and here.

Debt Dilemmas

Let’s address the debt dilemmas that exist here in the U.S. (which are not only isolated to the U.S., but this is primarily a domestic newsletter).

(If you follow the line at the right end of the chart, it goes right off the chart and stops at the moon.)

Is this bad? Well, I’m not an expert but I’d venture to say that it is not great if you are in debt greater than the value of what you produce. If you are an individual and your debts are greater than your income, you are in a world of financial hurt. But things are different when you are a nation, particularly a nation with the capacity to print currency. Let’s also remember that desperate times call for desperate measures, which is exactly the policy mentality that was taken with the first round of stimulus.

If you are wondering what the consumer side looks like, here you go:

The problem here is that consumers are expected to divert income toward ‘beneficial economic activity’ which is primarily seen through going out and spending the hard earned money on goods and services that you need and want. However, as we can see here, the first responsibility of both seasoned adults and post-university adults is reducing their large debt burdens. Particularly on the post-university side, the expectation is that these are the adults who are supposed to be generating large amounts of beneficial economic activity. Instead, the focus is on paying down 6 figures of debt on a degree which has been deemed necessary as the ticket of entry for many career paths.

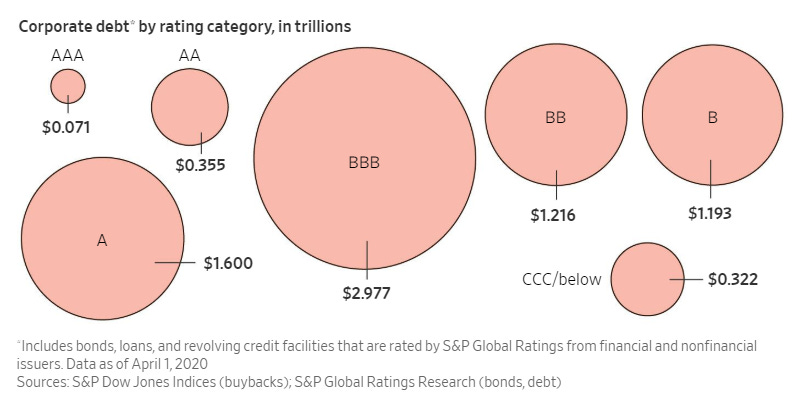

As for the corporate side, many large corporates have benefitted from the large-scale purchasing activity by the Fed, keeping their long term bonds afloat and the low-interest rate environment attractive to take on more debt.

Debt is a major part of a capitalism-based economy, and we’ve not seen what would be considered ‘the limit’ yet. Once we do, we will know.

Read more here.

Quick Takes

To fill in the gaps

K-Pop takes on Wall Street with label’s upcoming IPO. (via CNBC)

Race breakdown across corporate’s top executives. (via WSJ)

West coast wildfires devastate California’s wine country. (via WSJ)

More on COVID 19 vaccine trial participants. (via CNBC)

Goldman Sachs acquires another credit card partner, GM. (via WSJ)

The woes surrounding Trevor Milton and Nikola continue. (via CNBC)

COVID 19 cases tick upward in New York and other states. (via WSJ)

Speaking of supply chains, the pork industry is still in ‘survival mode.’ (via WSJ)

JPMorgan to pay $290 million to resolve probes on suspected market manipulation. (via WSJ)

A recap of the first presidential debate, if you can stomach any more of it. (via WSJ)

The in-app purchase fight continues, this time with Google. (via CNBC)

TikTok download ban blocked by Judge. (via WSJ)

COVID 19 has taken over 1 million lives globally. (via CNBC)

JPMogran makes a big market bet. (via CNBC)

The New York Times Trump tax leak report. (via NY Times)

Uber wins back temporary London operating license. (via CNBC)

Pelosi continues to push stimulus bills. (via CNBC)

Donnie and the First Lady test positive for COVID 19 among other cabinet members. Donnie transported to Walter Reed Hospital for treatment. (via WSJ)

General Banter

What’s on my mind

This new crossroads with Donnie contracting and spreading COVID 19 will be a really interesting one. Some close watchers of the presidential campaign by Donnie warned of his upcoming “October surprise” as the road to election day got closer. I don’t know if this was the surprise we were talking about, but a surprise nonetheless. Regardless, I think his contraction will shift the narrative on “hoax virus” and that no one is safe from COVID 19. As an aside, whoever has the task of this contact tracing, good luck to you; this one is a mess.

Reader’s Corner

A place for suggestions

The reader found a really interesting new newsletter, “In Gold We Trust,” to be rather interesting. Read about it and consider signing up here.

Here is the 2020 edition: In Gold We Trust report 2020 Extended

Do you like what you have read? Consider subscribing so that Market Madness is hand-delivered to your inbox each day! If you know of anyone missing out on Market Madness, save them the trouble and share it with them!

Behind the Madness

You’ve made it through the madness. I’ve worked really hard to ensure that you leave this page having learned something, and I hope that benefits you in your daily adventure. Thank you again for checking in.

Publishing Schedule: every Sunday

In the meantime, if you are interested in my thought process throughout the week as I collect news and ideas for the Sunday publication, please check out my Walling page where I brainstorm and mind-map each week’s edition!

Connect with Market Madness

For more Madness, check out the archive.

Some Sign-ups

That are definitely worth your time

Atom Finance: “Atom’s platform offers an ever-growing arsenal of powerful research and portfolio monitoring tools to anyone…” Sign up for a FREE account here.

Robinhood Sign Up: You get a stock, and you and you and you, and me! Follow my Robinhood link (if you’ve not signed up before) and we both get a randomly picked stock! A great way to get a jump start on investing, especially if you are hesitant to invest your own money at first. Your free stock is waiting for you here.

Koyfin: Financial websites have basic data and are cluttered with advertisements. Professional tools like Bloomberg are very expensive and difficult to use. Koyfin was created to provide investors with affordable and intuitive analytical tools to research stocks and understand market trends. Read more and join for FREE here.

TOGGLE: TOGGLE puts hedge-fund grade analytics within reach of every investor. Sign up for a FREE account here. Also, grab a FREE daily briefing for some tickers here.

Dirty Dozen Chart Pack (from Macro Ops): Good intelligence is vital. Great intelligence is priceless… Sign up to receive my weekly chart pack of the 12 most important and actionable charts that’ll make sure you kick your week off right. Sign up here.

Morning Brew: Become smarter in just 5 minutes. Get the daily email that makes reading the news actually enjoyable. Stay informed and entertained, for free. Sign up here. Grab their other, new, newsletters too: Emerging Tech Brew, Retail Brew, and Marketing Brew.

Investor Amnesia: a cool new email distribution for “your financial history fix through reading my articles, or those that I link to in my weekly ‘Financial History: Sunday Reads’.” Sign up here.

Axios News Sign Up: News worthy of your time. Get newsletters featuring news, scoops & expert analysis by award-winning Axios journalists like Mike Allen, Dan Primack and Ina Fried. View and sign up for their newsletters here.

The Hustle: Bold business and tech news. We cut through the noise with the most impactful headlines. Sign up here.

Wall Street Breakfast: Wall Street Breakfast, Seeking Alpha's flagship daily business news summary, is a one-page summary that gives you a rapid overview of the day's key financial news. Get today’s piece here.

The Water Coolest: The Water Coolest is a daily business news and professional advice email newsletter for young professionals. Biz news. Financial advice. Unfiltered commentary. One daily email. In 5 minutes or less. Sign up here.

DISCLAIMER ON SIGNUPS: I am not sponsored by any of these sites, companies, or individuals.

GENERAL DISCLAIMER: All rights reserved to respective sources where I pull my information. I do not own or have vested interests in the websites where I get my news and information. Links are provided as credit and to provide additional context where reader’s might want more information outside of what is printed here on these sheets.