Looking forward

Well folks, the indices are resembling the Little Engine That Could as we started the day. Ending H1 and the high growth Q2 in the green was a refreshing sentiment. Overnight, the futures signaled that the start of a new leaf (Q3 and H2) were going to open their eyes to red. But alas, a shining knight came in to change the mood! Pfizer released some details about their latest clinical trial for their COVID 19 vaccine, and it was good news! Additionally, the private payroll report for June was strong, only slightly missing on expectations. The June employment report coming out on Friday will be interesting; you can find that report here on Friday at 8:30 AM ET.

Elsewhere, the overseas indices were mixed, as the global community digests the new Chinese regulations imposed on Hong Kong, now in effect. European indices posted major gains on the quarter, some indices reporting the best quarter in a decade. Today’s gains were minuscule, partially attributed to news that broke suggesting Gilead has sold nearly all its supply of Remdisivir to the U.S. until September. How this will play out for international relations and the global fight against the virus, no one quite knows.

Looking back

Given how the first half of the year unfolded, we’ve made a significant recovery back to where the year started. Three of four major U.S. indices are still down on the year, with the Nasdaq being the exception, up over 15% on the year. Much of this comes down to where the firms in these indices operate. The Nasdaq index is comprised of technology companies, which have seen major increases during the quarantine months.

Looking more broadly at the other indices, which track the larger market, it makes sense that these are still in the red on the year given how the recovery path has taken shape. As we are leaving H1, and are prepping for Q3 and beyond, much still remains uncertain, which will keep a damper on the market at large from making a strong recovery and turning positive on the year.

Of course, once a clearer sense of what the rest of recovery looks like, a vaccine is developed and distributed to the masses, and companies are able to resume full scale capacity, only then will we get the market’s gears spinning at full speed and we will start to see more green than red. The double-edged sword of the market is that they always bounce back, but the frustration comes in determining when and how that comeback will take shape.

Did you miss the last edition? No worries! Get it right here and catch up on the madness.

Fundamentals

Wednesday Close:

Dow Jones Industrial Avg: -0.30%

S&P 500: +0.50%

NASDAQ: +0.95%

US 10 YR: 0.677%

Crude OIL: $39.78

Market Madness Portfolio: +0.66%

COVID 19 Global Cases: 10,708,181

Indices Overseas:

FTSE 100: +0.13%

Nikkei 225: -0.75%

Hang Seng: +0.52%

TEDRATE: 0.14

LIBOR (3 month): 0.30200%

Oh, here we go again.

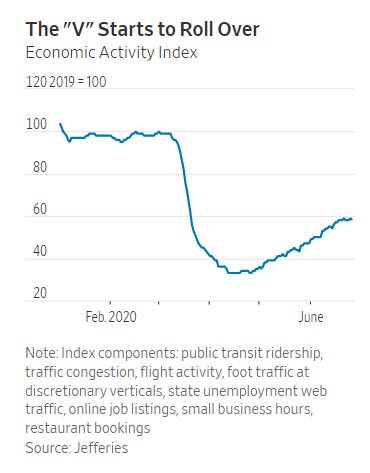

I think I might be sick if I see another prediction about the shape of the recovery curve. We’ve seen half the alphabet in predictions and, now, we are seeing the ‘reverse-square-root’ recovery path. I’m not saying that I don’t see it, but this path continues to change at least monthly, if not more frequently as new data comes to the public.

It is still too early to tell what impact the current new rise in cases will do to the recovery; states have rolled back some plans and others have put a pause on moving forward with their reopenings. At this moment, we could complete the chart and it would look like a ‘W’ given more companies have to close once again. However, we are still unsure.

The markets are pumping regardless. As we saw in the year-to-date (YTD) evaluation, we’ve recovered a lot of ground from the lows of March and April. What has been noticed over this movement, and for the last several years of market data, would be the tendency of the markets, and the underlying investors, to create self-reinforcing effects.

As traders, fund managers, and banks have migrated positions into ones that monitor and react based on volatility, activity can be changed or magnified based on where the notorious ‘fear gauge’ is heading. As risk taking and risk mitigating behaviors are taken up by market participants, those participants are more sensitive to movements in the markets. To cut back on potential risk, a trader or investor in the derivative space might have to sell their stock positions in a falling market, for example. These actions, on a large scale, will increase volatility and cause larger price swings than would otherwise.

It is still interesting to myself, and other market watchers, to see a continued gap between the financial markets and the underlying recovery data. Much could be attributed to optimistic speculation about recovery, and some attributed to this volatility-based movements we just talked about. Regardless, it is an interesting time to be watching what happens. We continue further into uncharted territory the longer we recover and more global events continue to muddy the water when all investors and the markets are looking for is an ounce of clarity. A lot of still up in the air, and movements up and down should be expected as we continue to cut through the fog.

Read more here on WSJ and here on FT.

Extra: Impact on Startups’ Employment

I came across this interesting infographic highlighting COIVD 19’s impact on employment at the large startups and wanted to share!

Quick Takes

Pfizer stock jumps after reporting positive COVID 19 vaccine trial. (via CNBC)

June payroll up 2.37 million, shy of expected 2.5 million. Positive revision made to May figure. (via CNBC)

Despite activity here and there, global dealmaking activity drops to lowest level in decade. (via FT)

Tesla surpasses Toyota as most valuable carmaker. (via FT)

United plans to add 25,000 flights to August rotation. (via CNBC)

Americans urged to limit July 4 activities. (via NY Times)

Reader’s Corner

The editor has taken a break for the holiday and will be back, refreshed, and ready to roll on Monday, July 6. Have a fun and safe holiday weekend.

Do you like what you have read? Consider subscribing so that Market Madness is hand-delivered to your inbox each day! If you know of anyone missing out on Market Madness, save them the trouble and share it with them!

Behind the Madness

You’ve made it through the madness. I’ve worked really hard to ensure that you leave this page having learned something, and I hope that benefits you in your daily adventure. Thank you again for checking in.

Daily Reader Count: 143

Connect with Market Madness

For more Madness, check out the archive.

Some Sign-ups (that are definitely worth your time)

Atom Finance: “Atom’s platform offers an ever-growing arsenal of powerful research and portfolio monitoring tools to anyone…” Sign up for a FREE account here.

Koyfin: Financial websites have basic data and are cluttered with advertisements. Professional tools like Bloomberg are very expensive and difficult to use. Koyfin was created to provide investors with affordable and intuitive analytical tools to research stocks and understand market trends. Our mission is to empower investors with high quality data and analytics to help them make more informed investment decisions. Most of all, we are obsessed with creating a delightful user experience. Read more and join for FREE here.

DataHub: Check out DataHub, a free (with premium upgrade options) data hub for information across multiple industries (see their available collections here). Check them out here and grab a free account.

TOGGLE: TOGGLE puts hedge-fund grade analytics within reach of every investor. Sign up for a FREE account here and grab a FREE daily briefing for some tickers here.

Robinhood Sign Up: You get a stock, and you and you and you, and me! Follow my Robinhood link (if you’ve not signed up before) and we both get a randomly picked stock! A great way to get a jump start on investing, especially if you are hesitant to invest your own money at first. Your free stock is waiting for you here.

Dirty Dozen Chart Pack (from Macro Ops): Good intelligence is vital. Great intelligence is priceless… Sign up to receive my weekly chart pack of the 12 most important and actionable charts that’ll make sure you kick your week off right. Sign up here.

Morning Brew: Become smarter in just 5 minutes. Get the daily email that makes reading the news actually enjoyable. Stay informed and entertained, for free. Sign up here. Grab their other, new, newsletters too: Emerging Tech Brew and Retail Brew and Marketing Brew.

Axios News Sign Up: News worthy of your time. Get newsletters featuring news, scoops & expert analysis by award-winning Axios journalists like Mike Allen, Dan Primack and Ina Fried. View and sign up for their newsletters here.

The Hustle: Bold business and tech news. We cut through the noise with the most impactful headlines. Sign up here.

Wall Street Breakfast: Wall Street Breakfast, Seeking Alpha's flagship daily business news summary, is a one-page summary that gives you a rapid overview of the day's key financial news. Get today’s piece here.

The Water Coolest: The Water Coolest is a daily business news and professional advice email newsletter for young professionals. Biz news. Financial advice. Unfiltered commentary. One daily email. In 5 minutes or less. Sign up here.

DISCLAIMER ON SIGNUPS: I am not sponsored by any of these sites, companies, or individuals.

GENERAL DISCLAIMER: All rights reserved to respective sources where I pull my information. I do not own or have vested interests in the websites where I get my news and information. Links are provided as credit and to provide additional context where reader’s might want more information outside of what is printed here on these sheets.