Too far, too fast?

Well folks, around the globe, we are seeing stocks retreat from recent highs, mainly attributed to growing investor worries about the potential resurgence of COVID 19. Investors in the U.S. have also lost some of their optimism after hearing the Fed’s highly uncertain outlook for the near-term future.

This downward pressure on optimism has outweighed the newly improved jobless claims number. This past week, we saw only 1.5 million Americans make jobless claims (compared with 1.877 million last week), bringing the total number to just under 21 million total Americans.

Did you miss yesterdays’s piece? No worries! Get it right here and catch up on the madness.

Fundamentals

Thursday Close:

Dow Jones Industrial Avg: -6.90%

S&P 500: -5.89%

NASDAQ: -5.27%

US 10 YR: 0.665% | 99 6 / 32

Crude OIL: $35.98

Market Madness Portfolio: -4.50%

COVID 19 Global Cases: 7,546,198

Indices Overseas:

FTSE 100: -3.10%

Nikkei: -2.82%

Hang Seng: -2.27%

Unemployment improvements

Obviously not the major headline today, but there was some glimmer of good news amidst the gloom. Last weeks unemployment claims came in lower than the week prior, a signal that there is some momentum coming back to businesses and the economy. The progression is slow, but still moving in the right direction. I think the economy has decided that the ‘V-rebound’ is not the right fit, and the economic recovery will need a longer, more gradual path.

On the whole, the numbers are improving. It is important to understand, however, that conditions will look drastically different based on your state. Some states did not have the proper unemployment insurance online systems that could accommodate the unexpected mass of new applicants. The archaic systems gave those who lost employment more delays in securing temporary relief payments. In addition, the level of frauds and scams have risen to capitalize on the confusion workers were facing with applying for and receiving unemployment benefits. Fortunately, Massachusetts had recently revamped their unemployment insurance website and service, and save for a long wait time if you need to call, it appears things have been smooth here. Of course, based on your state, your mileage may vary. If it is not one thing, its another, and it poses a great challenge to anyone who is not aware of the unemployment filing process suffering from scams or large delays. Provided that unemployment claims continue going down, we would hope to see less delays and lower levels of scamming, but that may only be wishful thinking.

Bad news bears

Today was interesting and much worse than I had expected or even thought about. Since the health community had been increasing concern about a second wave of COVID 19 for at least the past two weeks, it is opportunistic to use that as a sell sign after the Fed comes out with a gloomy future outlook.

There has been a growing worry by market analysts regarding the speed at which the markets were growing relative to the rather slow developing economic conditions. When these two mismatch, there is often unfavorable consequences.

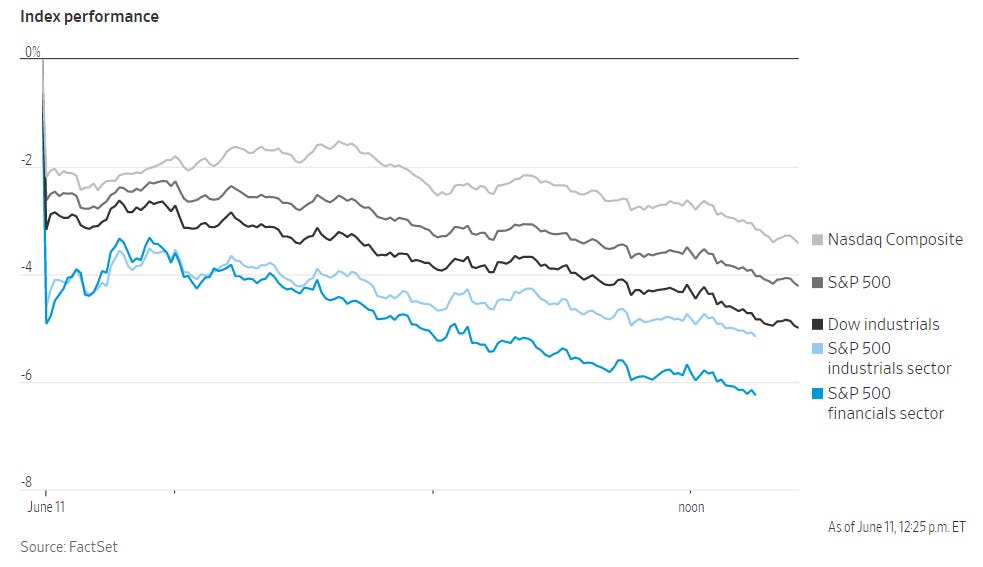

By midday, we were seeing much worse conditions than at the open:

This trend was not exclusive to the U.S., as we saw other global indices shed a decent amount of value overnight as well. U.S. COVID 19 cases have surpassed 2 million, and we are seeing worsening conditions in states that had reopened early. The dash to develop a vaccine continues, but investors appear to be losing hope. It does come at an interesting time however, because conditions have only marginally gotten worse since this past weekend, which the WHO considered an outlier for increased levels of new cases for COVID 19.

From what I have gathered, it does not look like investors are fearing another heavy round of lock downs, but rather changes to local policies that would be implemented to help curtail the virus’ spread. Understandably, this is a large disappointment to investors who are tired of being in lock down conditions and are ready for business as usual again.

It is tough to gauge the national response here in the U.S., as the COVID 19 task force on Capitol Hill has been all but disbanded, with no major updates or news coming from them. We continue to hear warnings from the health community as well as Dr. Fauci, but I’m unsure their effect on the populous.

Of course, we’d enjoy being able to say that we’ve seen the worst of this pandemic and that the road ahead is set aside for recovery and no more bad news. That would be nice, but given how things are shaping up this past week and today especially, it looks like those in different expert areas who have been suggesting the road ahead is going to be long and uncertain were right.

I’d say it is safe to say that forward momentum will not carry us back to the green by the market’s close and we should put this behind us and look forward to tomorrow.

Financial front running

Allianz’s chief economic adviser provided a strong opinion piece yesterday for the FT which proved to be very timely given today’s market collapse. In the article, he talks about the rise of corporate borrowings amid the Fed’s backstopping the debt market, and providing ‘limitless’ liquidity to credits that need it. Corporates have not had many options by which they can raise funds to continue meeting their fixed obligations and outstanding debt schedules. As a result, and given the low interest rate environment, it was a no-brainer for firms to pile on new debt with lower rates and longer repayment terms so that they can weather the short-term storm. What we have been seeing, at least in the short term, is that these facilities have given a rise in market confidence, as seen in the recent run up we saw last week and into this week.

However, the chief economic adviser poses a major ‘IF’:

“This huge rise in financial leverage will prove advisable and sustainable if, and only if, economic growth picks up quickly and validates it. In such a scenario, companies’ and countries’ use of debt to bolster cash buffers and offset massive revenue shortfalls would be deemed to have been a wise way to avoid temporary liquidity problems turning into a crippling solvency risk.”

“But if growth disappoints, the economy and markets will have to cope with a massive debt overhang that results in even greater central bank distortions of markets and lower growth potential. There will be widespread debt restructurings too, and disorderly non-payments.” (excerpted from article)

The problem is, the Fed has shown us that the economic recovery path is not likely to be as optimistic as the market was anticipating, realizing and widening the gap between finance and the economy. Today, we are seeing some consequences of when the Wall Street (finance) - Main Street (economy) gap becomes too wide and conflict one another.

Quick Takes

Overnight, GrubHub agreed to be bought out by JustEatTakeaway for $7.2 billion in an all-stock purchase deal. (via AXIOS)

“We can’t shut down the economy again.” says Treasury Secretary Mnuchin in response to second wave concerns. (via CNBC)

Future OPEC+ cut agreements are ‘uncertian.’ (via CNBC)

Moderna to start final stage COVID 19 vaccine trial in July. (via CNBC)

Shares of Tesla surpassed $1,000 yesterday as the company pushes forward with long-standing plan to produce semi trucks. (via WSJ)

Donnie and the Fed continue to bump heads. (via CNBC)

Apple plans $100 million racial injustice initiative. (via WSJ)

Vanguard looks to attract younger investors to their new robo-advisor platform. (via WSJ)

Total U.S. debt rises to $55.9 trillion. (via CNBC)

Reader’s Corner

The reader was looking at this article talking about gold as a risk hedging tool. A lot of gold was shipped into New York. Read more here.

General Banter

Still seeing lots of red well into the trading day. (timestamp 12:45 PM EST) Let’s buy the dip, nearly everything is on sale.

Behind the Madness

Thank you again for checking in.

Daily Reader Count: 133

Connect with Market Madness

On the web: http://marketmadnessnews.weebly.com/

Here on Substack: https://marketmadness.substack.com/welcome

@FromMadnessNews on Twitter

Email: christopherdolliney@gmail.com

Connect with me Professionally: https://www.linkedin.com/in/christopherdolliney/

Some Sign-ups

Atom Finance: “Atom’s platform offers an ever-growing arsenal of powerful research and portfolio monitoring tools to anyone…” Sign up for a FREE account here.

Koyfin : Financial websites have basic data and are cluttered with advertisements. Professional tools like Bloomberg are very expensive and difficult to use. Koyfin was created to provide investors with affordable and intuitive analytical tools to research stocks and understand market trends. Our mission is to empower investors with high quality data and analytics to help them make more informed investment decisions. Most of all, we are obsessed with creating a delightful user experience. Read more and join for FREE here.

Robinhood Sign Up: You get a stock, and you and you and you, and me! Follow my Robinhood link (if you’ve not signed up before) and we both get a randomly picked stock! A great way to get a jump start on investing, especially if you are hesitant to invest your own money at first. Your free stock is waiting for you here.

Dirty Dozen Chart Pack (from Macro Ops): Good intelligence is vital. Great intelligence is priceless… Sign up to receive my weekly chart pack of the 12 most important and actionable charts that’ll make sure you kick your week off right. Sign up here.

Morning Brew: Become smarter in just 5 minutes. Get the daily email that makes reading the news actually enjoyable. Stay informed and entertained, for free. Sign up here. Grab their other, new, newsletters too: Emerging Tech Brew and Retail Brew.

The Hustle: Bold business and tech news. We cut through the noise with the most impactful headlines. Sign up here.

Wall Street Breakfast: Wall Street Breakfast, Seeking Alpha's flagship daily business news summary, is a one-page summary that gives you a rapid overview of the day's key financial news. Get today’s piece here.

DISCLAIMER ON SIGNUPS: I am not sponsored by any of these sites, companies, or individuals.

GENERAL DISCLAIMER: All rights reserved to respective sources where I pull my information. I do not own or have vested interests in the websites where I get my news and information. Links are provided as credit and to provide additional context where reader’s might want more information outside of what is printed here on these sheets.

Do you like what you have read? Consider subscribing so that Market Madness is hand-delivered to your inbox each day! If you know of anyone missing out on Market Madness, save them the trouble and share it with them!