Information overload

Well folks, happy Memorial Day and I hope you all enjoyed the long weekend. With the markets being closed today here in the U.S., it gives us an uninterrupted opportunity to cover off on some current events in the markets and prepare for the week ahead.

Fundamentals

Friday Close:

· Dow Jones Industrial Avg.: -0.04%

· S&P 500: +0.24%

· NASDAQ: +0.43%

· US 10 YR: 0.661% | 99 7/32

· Crude OIL: $33.45

· COVID 19 Global Cases: 5,529,098

International Edge:

· FTSE 100: -0.37%

· Nikkei: +1.73%

Commercial paper wrinkles

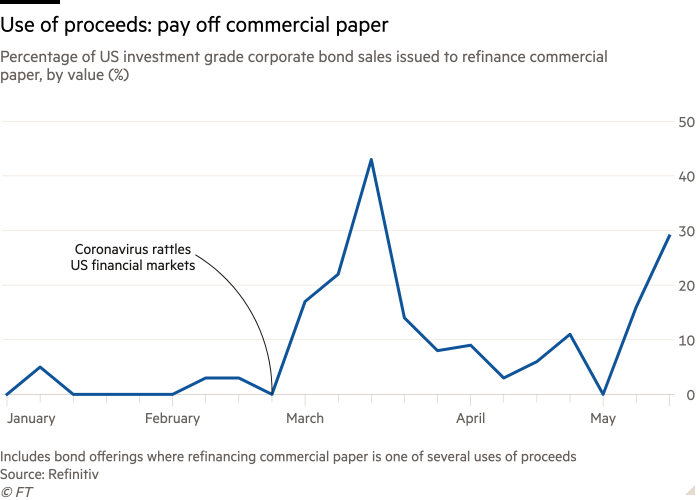

In the wake of such low interest rates, corporates are seeking alternatives to the once widely used commercial paper market. Commercial paper is a short-term unsecured debt instrument that is issued with very short maturities, within 270 days typically. These instruments are often used by companies to finance payroll or inventory obligations (anything in the short term financing realm). The market for commercial paper is huge, over $1 trillion.

More than 40 large corporate firms have raised over $97 billion in long-term debt, ditching commercial paper in favor for longer-term, low interest obligations.

We can see that many firms are issuing longer term debt in order to reduce its load of commercial paper and have more favorable refinancing. Combined with the newfound U.S.-China tensions dropping U.S. yields even more, companies are finding the bond market to be even more favorable.

“Overall it is more efficient to finance for two to five years than it is to do so in the commercial paper market,” said Guy LeBas, a strategist at Janney Montgomery Scott. “With the yield curve so low in absolute terms, from a treasurer’s standpoint, it is a lot safer to secure funding [elsewhere].” (excerpted from article)

It will be interesting to continue following up with this area. The Fed had supplied large amounts of funding in order to keep the commercial paper market supported throughout the COVID 19 market shake-ups. As companies seek to capitalize on the historically low interest rates, it only makes sense to move out into a longer horizon. Companies are able to secure much longer financing options in the debt market and currently no longer need to worry about shorter term outlooks. With the current short-term being so uncertain, it helps firms be able to finance in the longer term and at low rates, such that they can make repayment obligations manageable even with low, or no, income coming into the business.

Read more here about the developments in commercial paper: https://www.ft.com/content/1c9c9b08-f993-40ed-94d4-9f3f2da45433

Roadshow runaway?

The FT had two strong articles about the developments of what has now become a massive IPO backlog in the wake of market slowdowns. As we just had discussed, many firms have sought funding from the debt market amid low interest rates and the spike in equity selloffs we saw in March and into April. Market selloffs do not pose a good time to take a company public as investors are already unwilling to take risks on established companies. However, as the market has calmed down and started to regain some traction, many firms who had to pause their IPO are seeking to get the wheels turning once again.

The current challenge being faced is timing out new IPOs in order to have the greatest success in the equity market. Volatility and perceived credit risk have cooled off, but the BoA bull and bear indicator is still suggesting a bumpy road to come. The other challenge comes in the form of conducting the roadshow.

A roadshow is a sales pitch to potential investors leading up to a new IPO. The firm underwriting the IPO will pitch the new stock to a series of investor pools to gauge appetite in the market for the new company’s stock. This helps determine how many shares are issued and at what price in the initial offering. This is traditionally a process done in-person, traveling to investors across the U.S.. This, of course, has been put on pause due to COVID 19, but not for every company. We talked in the past about JDE Peet’s and their IPO in the European market. They conducted a virtual IPO, which is something that other company’s are considering in order to keep their IPO ball rolling.

BNP Paribas, one of the lead underwriters in the Peet’s deal, suggested that although you cannot meet face-to-face with investors they are pitching to, they are able to meet with a lot more people than the traditional process allows. There are good and bad aspects to this change in presentation style. Some have mentioned that the overall tone and mood are much lighter (with some special guest appearances from babies on the calls), and others have noted that it has become much more difficult to persuade and win over investors via telecommunication.

For better or worse, this form of roadshow might be here to stay and is the current go-to-market strategy for companies looking to IPO ASAP. For underwriters with success in this area, it might be a new edge they can bring to attract companies looking to IPO.

Read more here about these two articles regarding IPOs and roadshows: https://www.ft.com/content/5ad15369-a63a-4a97-8c17-0f13d52578f7 and https://www.ft.com/content/d4cff7ea-a377-4c78-96fc-604d95479070

Quick takes

· Latvia aims to be the first country to launch contact tracing app across Google and Apple co-op. (via ATOM+)

· NYSE’s floor set to re-open tomorrow, Tuesday, May 26. (via WSJ)

· Russia looks to ease some lockdown measures in different regions. (via Reuters)

· Bank of Israel keeps benchmark interest rate a 0.1%. (via Reuters)

· Coronavirus related scams have cost Americans over $39 million. (via CNBC)

· The Reserve Bank of India cut its benchmark rate unexpectedly 40 basis points to 4.0%. (via CNBC)

· AT&T told to stop using “5GE” label for its current market service. (via WSJ)

Reader’s Corner

The reader found a good opinion piece on the FT about U.S. banks and dividends. Read that here: https://www.ft.com/content/182e8048-09f0-45bc-8365-0c0ba63a92ac

Reuters Graphics published a really cool timeline tracing the growth in COVID 19 cases globally. See that here: https://graphics.reuters.com/CHINA-HEALTH-MAP/0100B59S39E/index.html

Behind the Madness

Thank you again for checking in.

Daily Reader Count: 93

I posted on LinkedIn about this idea, but I also want to consider doing a once-per-week, premium article called ‘Research Madness’ where I will dive into either company analysis or into journal articles and white papers from professional research and investing institutions. This will also be an additional subscription that you can get on top of the free daily Market Madness letters. If you are interested, please let me know!

I have established a donations page on the website for those who feel adamant about giving back to Market Madness. The newsletter will always be a free service, so don’t you worry! (https://marketmadnessnews.weebly.com/store/p1/A_penny_for_my_thoughts....html)

I am working on some small learning kits to teach and help you practice different financial concepts. These will be called ‘toolkits’ and will most likely be a paid feature to supplement the free newsletter. If you are interested in these, shoot me an email and I can send you a demo version! I’ll let you know when they go live and you can find more details on the Market Madness website, under the ‘store’ page.

Connect with Market Madness:

On the web: http://marketmadnessnews.weebly.com/

@FromMadnessNews on Twitter: https://twitter.com/FromMadnessNews

Email: christopherdolliney@gmail.com

Connect with me Professionally:

https://www.linkedin.com/in/christopherdolliney/

Some Sign-ups:

Atom Finance(https://atom.finance/welcome?inviteCode=sharedbycdolliney)

“Atom’s platform offers an ever-growing arsenal of powerful research and portfolio monitoring tools to anyone…”

Robinhood Sign Up: You get a stock, and you and you and you, and me! Follow my Robinhood link (if you’ve not signed up before) and we both get a randomly picked stock! A great way to get a jump start on investing, especially if you are hesitant to invest your own money at first. Your free stock is waiting for you here: https://join.robinhood.com/christo2725

Dirty Dozen Chart Pack (from Macro Ops): https://macro-ops.com/monday-dozen-sign-up/?utm_source=ONTRAPORT-email-broadcast&utm_medium=ONTRAPORT-email-broadcast&utm_term=Collective+Sales&utm_content=Your+Monday+Dirty+Dozen+%5BCHART+PACK%5D&utm_campaign=03302020 Good intelligence is vital. Great intelligence is priceless… Sign up to receive my weekly chart pack of the 12 most important and actionable charts that’ll make sure you kick your week off right.

Morning Brew:https://www.morningbrew.com/daily/r/?kid=01196f Become smarter in just 5 minutes. Get the daily email that makes reading the news actually enjoyable. Stay informed and entertained, for free.

The Hustle:http://ambassadors.thehustle.co/?ref=7fead7962a Bold business and tech news. We cut through the noise with the most impactful headlines.

Wall Street Breakfast:https://seekingalpha.com/author/wall-street-breakfast#regular_articles Wall Street Breakfast, Seeking Alpha's flagship daily business news summary, is a one-page summary that gives you a rapid overview of the day's key financial news.